This year marks the 8th year of the bull run which started in March 2009. It’s a cycle which has shown resilience against all odds and propelled the index higher by 240%. In fact, untoward incidents that were expected to have massive repercussions for the market’s upward journey, like Brexit, Trump election, Fed’s taper – only turned out to be minor obstacles that the market not only overcame but used them as a springboard to scale newer heights by defying conventions.

Now a typical bull market lasts on an average for 56 months – the current bull market is 102. With only a few historical precedents to the age of the current bull market, this bull run has been sparking concerns amongst investors about its age and related vulnerability. Should the investors stay in the game or prepare their portfolios for a possible market crash?

Firstly let’s try to understand what is driving this long 8-year bull run?

- Global economic growth is picking up

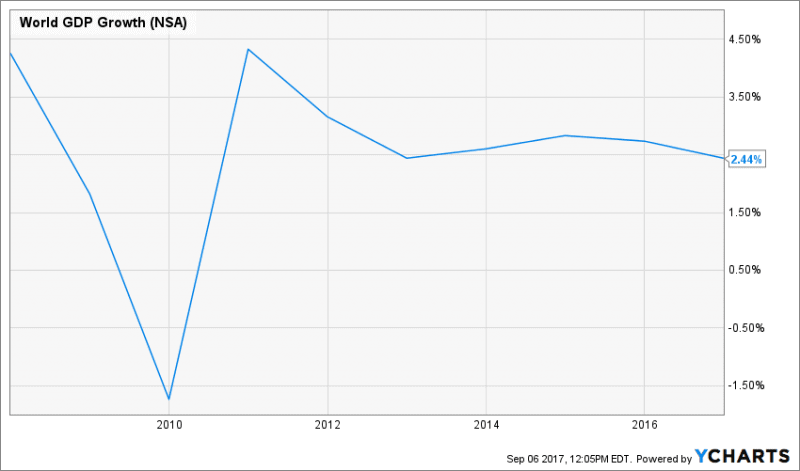

The global economy today is very different from the post-2009 crash period when most of the economies struggled from zero/negative growth. This bull run is being fuelled by economic growth not only in the US, but worldwide. In contrast with most bull runs in the past that were impacted by a recessionary trend, the current macro environment remains supportive of a continued bull run. Also, this rally was initially triggered by a liquidity influx from central banks but is now being driven by expectations of earnings growth from economic recovery – thus giving it more credibility. And while global economic growth is slowly picking the pace, the inflation remains subdued and this puts the current bull cycle in a rather sweet spot.

- S&P corporate earnings remain strong

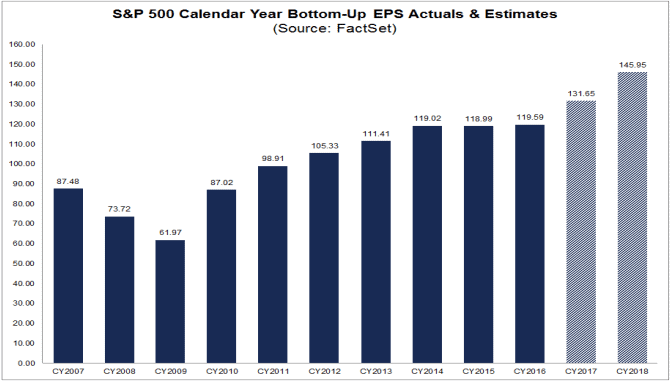

S&P earnings have shown a steady growth since the 2009 recession and have been supporting this bull run. While in the initial years of the bull cycles, corporations were able to recover earnings by cost cutting, the trend has now shifted to earnings increasing from economic growth recovery and expected structural reforms from Trump’s pro-business policies. This shift of corporations from survival mode to thriving mode portends a sustainable earnings environment for the corporations and is positive for stock markets.

S&P earnings have shown a steady growth since the 2009 recession and have been supporting this bull run. While in the initial years of the bull cycles, corporations were able to recover earnings by cost cutting, the trend has now shifted to earnings increasing from economic growth recovery and expected structural reforms from Trump’s pro-business policies. This shift of corporations from survival mode to thriving mode portends a sustainable earnings environment for the corporations and is positive for stock markets.

How is this cycle different?

Let’s take the last two market crashes – what caused them? While the market 2008-09 crash was trigged by the housing bubble and subsequent financial crisis, the market crash in 1999 happened from the tech bubble bursting. Both the bull cycles preceding these crashes were characterized by extreme investor euphoria about increasing market returns (unjustified valuations) and had a recessionary economic environment in the backdrop. However, for this bull run,

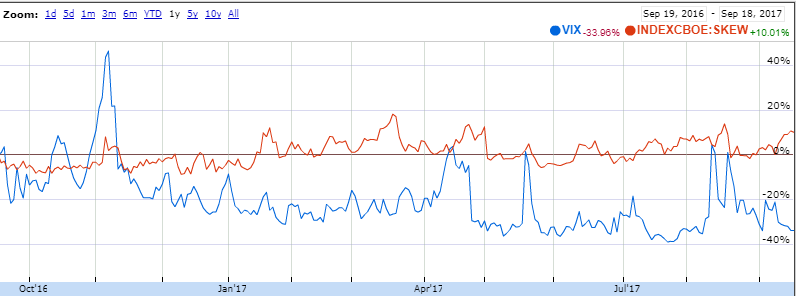

- The euphoria typical of a bull market is missing

VIX recently fell to 10, way below its historical average of 19. Low volatility is being quoted as a sign of market complacency. However, VIX is a sentiment indicator – and while markets tend to be swayed by sentiments like fear/greed in the short term, the long-term market is driven by fundamentals. In fact, the markets this time do not necessarily seem to be complacent. SKEW (the black swan index) that tracks the probability of unknown events has risen to record levels and remains elevated. A low VIX and a rising SKEW give conflicting signals about investor complacency – there is no undisputed indication of euphoria in the market.

- There is no bubble in the horizon

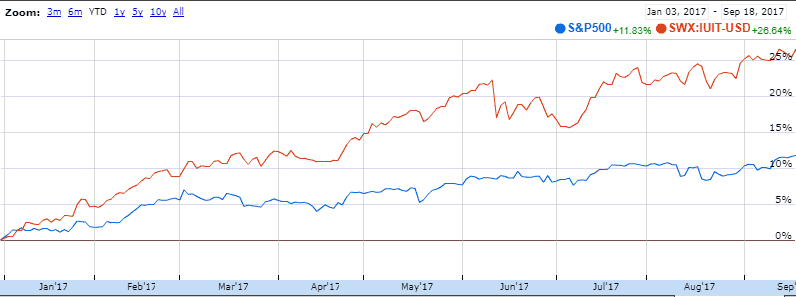

FAANG stocks have been driving the market recently. S&Ps tech sector has risen 27% YTD vs S&Ps rise of 12%. The tech sector might be overheating, but a dot-com kinds bubble doesn’t seem to be in the making. Why?

- The FAANG stocks are mammoths with real earnings and massive cash balances – they are robust enough to withstand external disturbances unlike the dot-com era start-ups with their shaky business models.

- An increasing aversion amongst tech players to go public has given rise to Unicorns (private companies worth over $1 billion), that is being increasingly financed not by retail investors via IPOs but private players like VCs/PEs. Unlike the dot-com era, when retail investors got burned when the bubble burst, this time a lot of these overvalued businesses are private and are being financed by institutional investors, with higher capacity to absorb potential shocks

Are the drivers of the current bull run sustainable?

- Global recovery tepid but steady

The current recovery appears to be sustainable. Why?

-

- It is more broad-based

Per the IMF’s July Economic Update, advanced economies are forecast to grow at 2% in 2017, with Eurozone (1.9%) and Japan (1.3%) picking up pace – these economies were languishing with negative growth and dragging down global growth post-crisis, but there is a turn of tide now, with these economies showing growth momentum. Amongst emerging economies, China growth has stabilized and is expected to grow at 6.7% in 2017

-

- Marked by low inflation

Despite the recovery in global economic growth, global inflation continues to remain benign. Low inflation is more conducive to economic growth and suggestive of the fact that global economic growth hasn’t overheated or reached a saturation point yet

- Corporate earnings supported by multiple catalysts

S&P corporate earnings growth rate has risen – from 1.7% in Q3 2016 to 17.7% in Q1 2017. This sharp rise has been supported by multiple catalysts. 1) A robust economic recovery is driving business growth and increasing capacity for new business investment. 2) US economy, operating at full employment levels, has increased consumer capacity to spend and invest.

Increasing personal spend and business investment are supporting higher stock prices. Trump reforms are expected to add to this momentum. Agreed, he might not deliver on all his promises, but the likelihood of some form of tax reforms remains likely if not all. Even the smallest of tax reforms could immediately boost corporate earnings.

Threats to the bull run remain

While these indicators are encouraging, investors should be alert to various caveats that might be potential catalysts in derailing the bull run.

- China is a threat to global economic growth

China’s hard landing concerns may have abated, but in absence of structural reforms, doubts about the sustainability of its debt-fuelled growth remain. Given that it contributes 1/3 rd of the world GDP growth, a slowdown in China, with a drop of even 1% could dent global economic growth by 0.3%.

- Trump reforms might not materialize

Investors bought into equities post-Trump elections in anticipation of a rise in corporate profits from his proposed pro-business reforms. Since then, constant delays in enacting reforms have created doubts about Trump’s ability to see through his plans. Any news confirming these doubts might lead to a significant pullback by investors – not so much because of the lag in expected earnings but because sentiments will be deeply hurt.

- Geopolitical risks could hurt trade and sentiment

Escalating tensions in North Korea, a potential US-China trade war, ongoing Brexit talks continue to dot the global market landscape. These threats could be potent enough to trigger a panic across the global markets and encourage massive sell-offs. Even if they do not cause panic, they do continue to feed into market nervousness which could impact market valuations as investors reprice the risks

- Rising inflation – fed might increase rates at faster pace

The global recovery is picking up and inflation is tame. The current rate rises by Fed have been propping the markets as they take it as a sign of economic confidence. However, once the global recovery picks up pace and inflation starts rising, the Fed will resort to increasing interest rates at a much quicker pace, which will hurt corporate earnings and subsequently stock prices

The verdict

The bull-run, it seems, is here to stay. The drivers seem sustainable and the investor sentiment is not close to euphoric. But given the external threats to the bull market’s longevity, complacency is not desirable. Short-term corrections and market volatility are expected in the near term – be it from profit taking, corporate earnings swings or geopolitical factors. So is there a way to reduce one’s risk without giving up on the bull market’s potential upside? Here are a few strategies to keep in mind while sensibly riding this bull run:

- Continue to invest in equity, albeit in a staggered way: Investors should keep a medium to long term horizon and continue with regular equity investments. Staggering their investments through SIPs will help the investors ride through the short-term volatility and avoid the pitfall of making lump sum investments during market peaks

- Reduce portfolio risk: High-risk investments like penny stocks should be strictly avoided, as they are most vulnerable in a market downturn. Investors should scan their portfolio for overvalued stocks; focus on stocks with stronger fundamentals and sectors that they are comfortable with. They should avoid concentrating their investments in a single sector

- Avoid the urge to make quick money: Smaller investors are recommended to avoid day trading or to dabble with exotic investments they don’t understand. They should avoid leverage.

- Consider insuring portfolios: With volatility at historical lows, buying deep out of the money calls of volatility indexes like the S&P VIX Index is a cheap way of ensuring against an unexpected downturn in markets. The payoff on the long-dated deep OTM options is significant if for any reason, there is a major correction in markets.

01/01/2018 at 7:27 am

nice one