INTRODUCTION

Once you have decided ‘where’ to invest your funds, it’s also important to think about ‘how’ to invest them. There are several instruments that you could use to maximise your returns with or without increasing exposure and risk. We will be looking at derivatives in this article to increase your returns.

When you are looking to invest your funds, you could invest in an asset itself or you could look at investing in a derivative of that asset. For instance, you could either buy a house as a financial investment, or you could buy a fund or a financial instrument that tracks house prices. In both cases, you are betting on house prices going up but in the case of a derivative, you don’t actually own a house. Your rights and obligations differ under these two options, and this distinction is important to remember.

The content on this page could be overwhelming for some, but once you master the basic principles, you could create and profit from your own strategies. However, if you still struggle, please drop us a note or post a comment below indicating on what areas you would like more or better explanation.

UNDERSTANDING THE RISKS

Derivatives could help you generate higher returns, or even hedge your portfolio in case of uncertainties. However, the key here is to be DISCIPLINED. Several individuals leverage themselves to a level of exposure that they can’t afford, and a price move in the opposite direction could even wipe out their net worth! Tread carefully!

We believe that stock markets and financial instruments provide better odds than a casino, and with good research, you could generate high returns, but just like in a casino, you should only bet money that you can afford to lose.

Investing 101 – Let’s get you started in the stock market.

HOW LEVERAGE WORKS?

Leverage is how institutional traders and investors generate significant return on their capital. Also, financial leverage has been successfully used by big corporates and private equity firms to maximise returns for shareholders.

Let’s say you would like to invest $100 in Apple stock, and let’s assume that the stock moves +/- 10% annually.

Option 1 is to invest $100 in the stock, and ‘own’ it.

Option 2 is to leverage your investment. Since you think that the stock can go down 10%, you should put at least 10% as margin i.e. your leverage is 10 times (100%/10%). Hence, you invest only $10 ($100 * 10%) to buy a derivate of the stock. Your exposure to the stock remains at $100 but you do not ‘own’ the stock.

Under option 2, if the stock moves up 10% to $110, you would make a profit of $10 and of course if it moves down to $90, you could lose $10. All of this on an investment of $10. As you can see, a 10% movement in the stock could give you a 100% return, or in case the market moves against you, you could lose all of your initial deposit, and you will need to add more funds to your account. We will be explaining this in more detail in a future post.

INVESTMENT STRATEGY

We will now look at a few investment strategies, and how change in financial instruments used, portfolio allocation, and the level of risk could affect your return. For all of these strategies, we assume the following:

You would like to invest $1,000 into 2 assets:

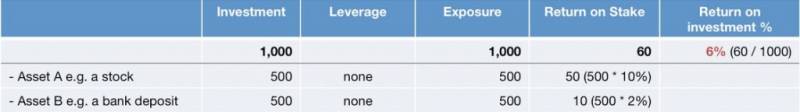

– Asset A e.g. a stock with high risk and an average annual return of 10%

– Asset B e.g. a bank deposit or an income fund with low risk and an average annual return of 2%

INVESTMENT STRATEGY 1 – SIMPLE TO UNDERSTAND AND EXECUTE

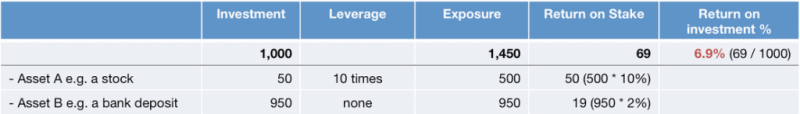

INVESTMENT STRATEGY 2 – LEVERAGE BUT ARGUABLY WITHOUT INCREASE IN RISK

Since we would not like to increase our risk, we should restrict our exposure in risky asset A to $500, but instead of investing entire $500, we invest only $50 with a leverage of 10 times. Now we have $950 ($1,000 – $50) to invest in the low risk Asset B. Your overall investment remains the same at $1,000, but your overall exposure increases to $1,450 from $1,000 earlier, and your return increases to 6.9% compared to 6% in strategy 1. A 0.9% increase may seem small to some, but over a period of time, it could fund a vacation, a car or a house.

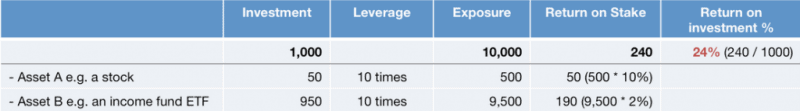

INVESTMENT STRATEGY 3 – HIGHER LEVERAGE WITH AN INCREASE IN RISK

You could also leverage your investment in low risk asset B by choosing for instance an income fund ETF. By leveraging it 10 times, your overall exposure increases to $10,000 and your return to 24%, while your investment is still $1,000.

An exchange-traded fund (ETF) is an investment fund traded on stock exchanges, much like stocks. An ETF holds assets such as stocks, commodities, or bonds, and trades close to its net asset value over the course of the trading day. In our example, an income ETF is a derivative of an income mutual fund which has a low risk return profile.

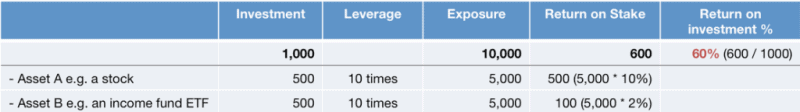

INVESTMENT STRATEGY 4 – HIGH RISK AND HIGH REWARD

This is a very high risk strategy and should only be used once you understand how these leveraged products work, are comfortable with the level of risk, and can invest with proper stop losses. By increasing exposure to the risky asset A, you could increase your return to 60%. Remember now you have $5,000 exposure in the risky asset A, and any adverse movement in the stock could significantly affect your finances.

You could also generate higher returns than in Strategy 4, but that would also increase the level of risk. Keep reminding yourself of this quote every time you trade:

“The Market Can Remain Irrational Longer Than You Can Remain Solvent”

OTHER CONSIDERATIONS

While, in this article, we have focused just on monetary returns, there are several other factors that need to be considered in deciding the right strategy for you.

– Taxability of your investments – this could differ from country to country and from individual to individual. Spread betting is tax free in the UK subject to certain conditions, but could be charged at a higher than normal tax rates in certain countries.

– Availability of time – You may need to devote more time when dealing in leveraged products compared to just buying an asset directly.

– Transaction costs – Make sure you understand how your broker charges for transactions, as they may vary significantly for different instruments.

– Trading or investing time horizon – You should keep in mind that leveraged products usually have an expiry date, and you may have to ‘rollover’ your position to continue having exposure to the security.

ARE YOU READY TO IMPLEMENT ANY OF THESE STRATEGIES?

If you have understood the strategies above, and feel like giving any of them a go, we recommend that you start with virtual money or a demo trading account, and then move to trading with real money. Even then, you may want to start with very small sums of money.

Most brokers offer a choice between spread betting and CFD (contract for difference). You may decide based on your personal situation and location. For instance, as on the publish date, spread betting is free of UK capital gains tax subject to certain conditions, while profit from CFDs is taxable in the UK.

The author trades mainly through City Index as they provide a good range of markets including equity futures and ETFs, and the (transaction) costs are reasonable. They also offer a demo trading account and have a good ‘learn to trade’ section for you to start off on. However, you’ll need some time to get accustomed to their platform.

Please note that the service may be only available in certain countries. If City Index is not available in your country, you could look at ETX Capital and/or eToro but their range of markets is limited for the purposes of these strategies.

Please do let us know of your experience if you trade / invest with any of the mentioned brokers in the comments below.

DISCLOSURE: We receive compensation from the services mentioned above if you enroll with them, but we assure you that we always stick to our values and would never recommend you a service just for our monetary benefit.

WHAT’S NEXT?

Leave a Reply