I’ve invested in several companies on Seedrs and Crowdcube, and there are a couple of major challenges I face:

- I don’t have enough tools and data to conduct my research and due diligence prior to investing in a company,

- After investing, I’m at the mercy of the founders to provide regular updates on the business.

We, at CityFALCON, are working towards solving these two issues, and we have started with providing all the news, tweets, research, companies and statutory filings from Companies House, Gazette, SEC, and other agencies, and alternative data starting with Trustpilot Ratings. Also, we have identified sectors, industries, subindustries, and categories that these companies belong to which will allow you to learn more about the competitive landscape. On top of all this, you have all the other features such as watchlist management, selecting sources, etc. We leverage machine learning, AI, and Big Data to achieve this. Soon we will launch more analytics, insights, and alerts to reduce the amount of work you need to do and to reduce the chance you will miss important updates, events, and opportunities.

We currently analyse data for millions of companies (10m+ as of Sept 2020) and already deliver that data for some companies to users. As we test the quality of the data and our analytics, we will start to open up the rest of the companies in our database to our users. You could see the full coverage of what we offer here.

All of the data that we show on our platforms is also available through our API, which will allow you to embed this content within your own products and/or create your own algorithms to track and manage on an automated basis.

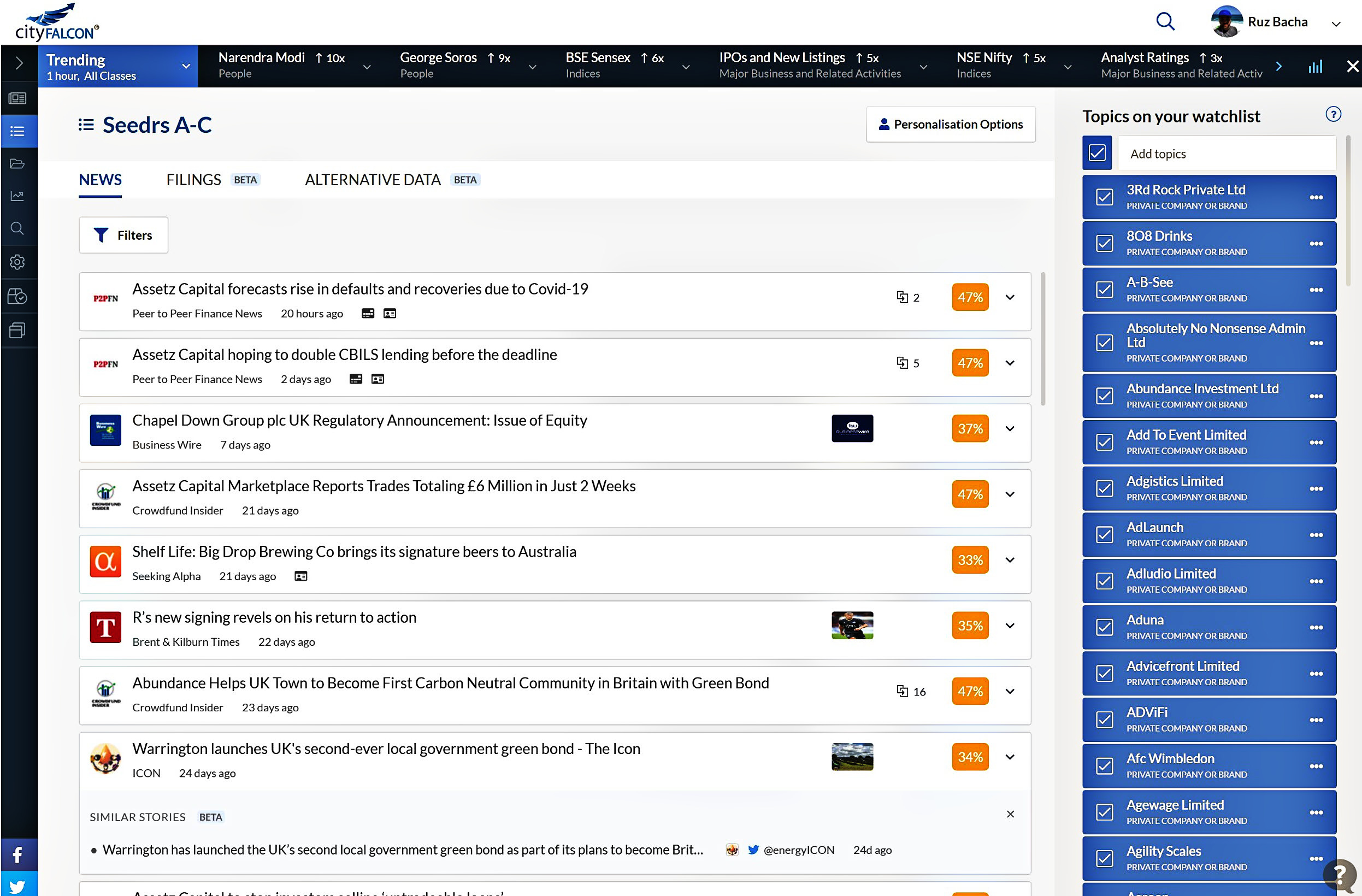

To help you get started, we have created some prepopulated watchlists that will get you started with a click of a button.

Fundraising from Seed to Series A, B, C, D…

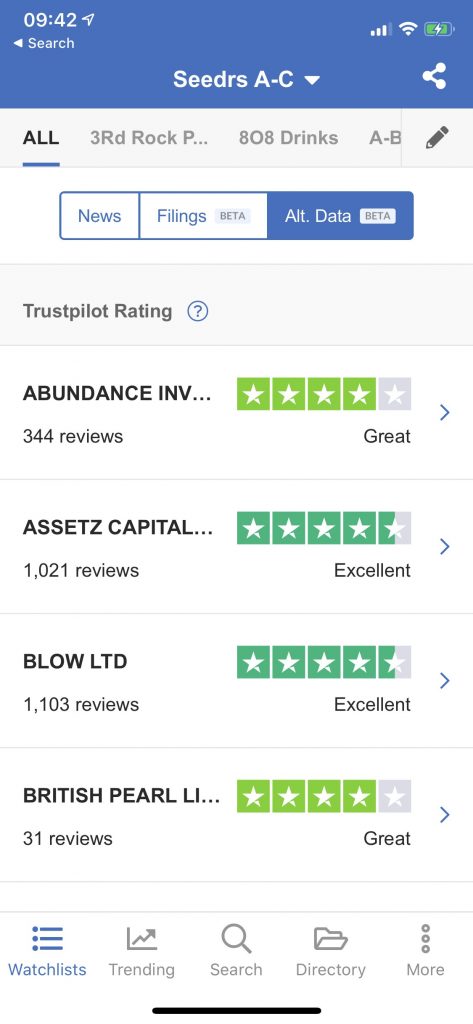

These screenshots are examples of how a watchlist and associated filings and alternative data look on the web and mobile platforms. You can test it out yourself using any of the links above.

Initial Research and Due Diligence

Here are the things I focus on while investing in a private company and will also explain how you can leverage our platform for this. The presumption here is that you already like the idea and/or the industry in which the startup is operating in.

1. Do you trust the management in general and to deliver the idea? This is the toughest to do as at most times you don’t even get to meet the founders. What I look at are the passion of the entrepreneurs in the video(s) and text, their professional and educational backgrounds, and whether there are any red flags. For me, the red flags are when founders oversell their company, misrepresent any data e.g. “users”, avoid answering some questions, etc. If the company has raised money already, I look at whether they are regularly providing updates.

We will soon launch some Know The Founders tools by gathering as much as data as we can on track records and other indicators.

2. Does the company have enough runway? One of the main reasons early-stage companies fail is that they don’t have (access to) enough funds to run the business. Fundraising is one of the hardest things I’ve done on our own startup journey. There are a few things to look at here:

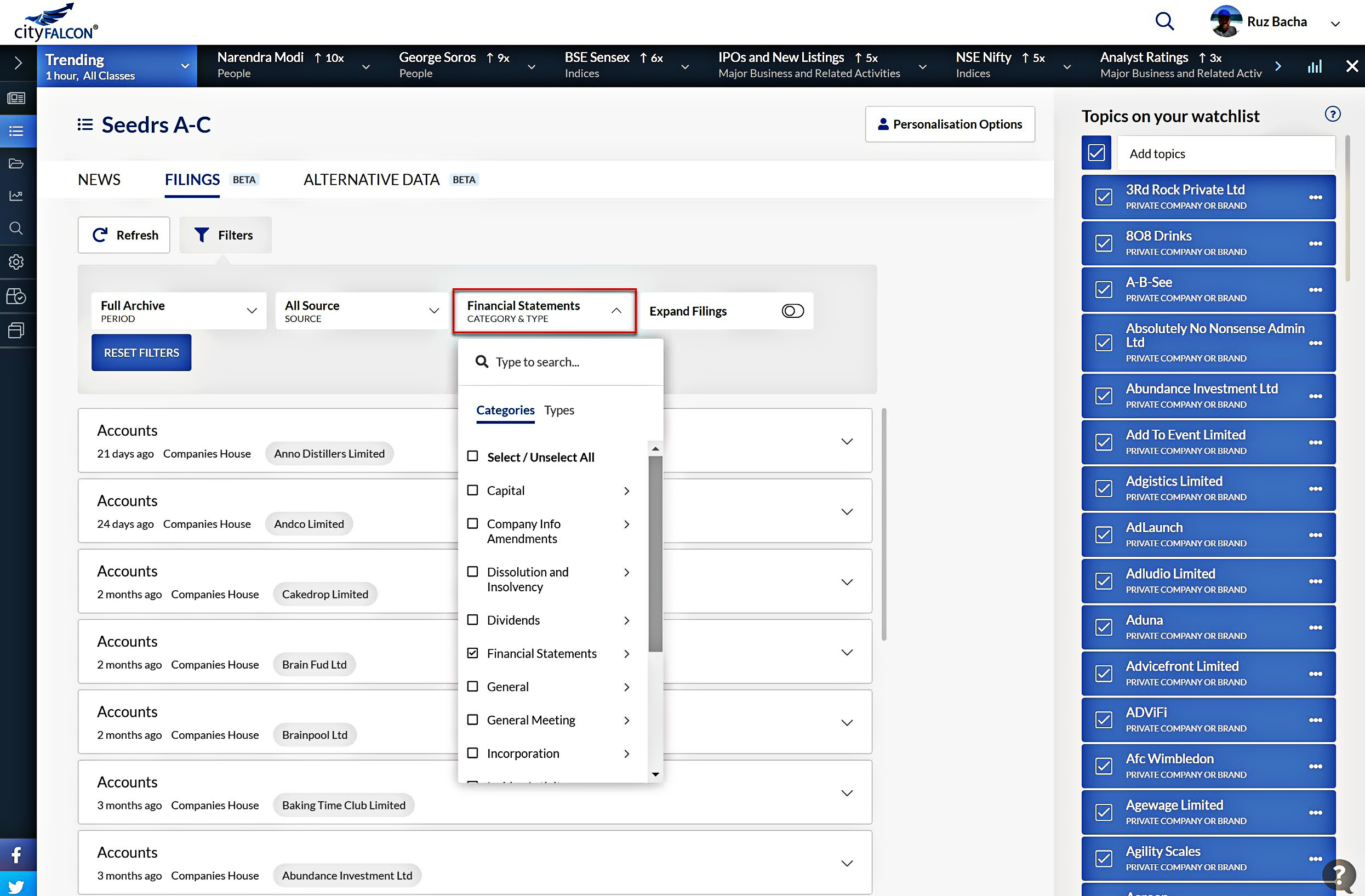

a. Discipline with cash flow management – You’d be surprised how many companies do not manage management accounts on an ‘accrual’ basis, and this leads to them not knowing the actual burn rate. Also, delay in paying the suppliers, employees and others can rack up debt and creditors on the books. One of the ways you could look at it is by looking at the financial statements submitted to the Companies House. These are, of course, delayed, but can be still helpful in understanding the trends, ratios, and historical performance. On top of that, investors should always review recent financial statements and projections, too.

Below is a screenshot of how to use CityFALCON to look at the financial statements for companies of interest. You could select the ‘Financial Statements’ category under the ‘Filings’ tab to narrow down the results.

b. Do the existing investors have the ability to support in case of cash flow issues? Existing investors with deep pockets help and so it is important to know who has invested in the company. Companies are likely to survive longer, on average, if they are supported by VCs and institutions.

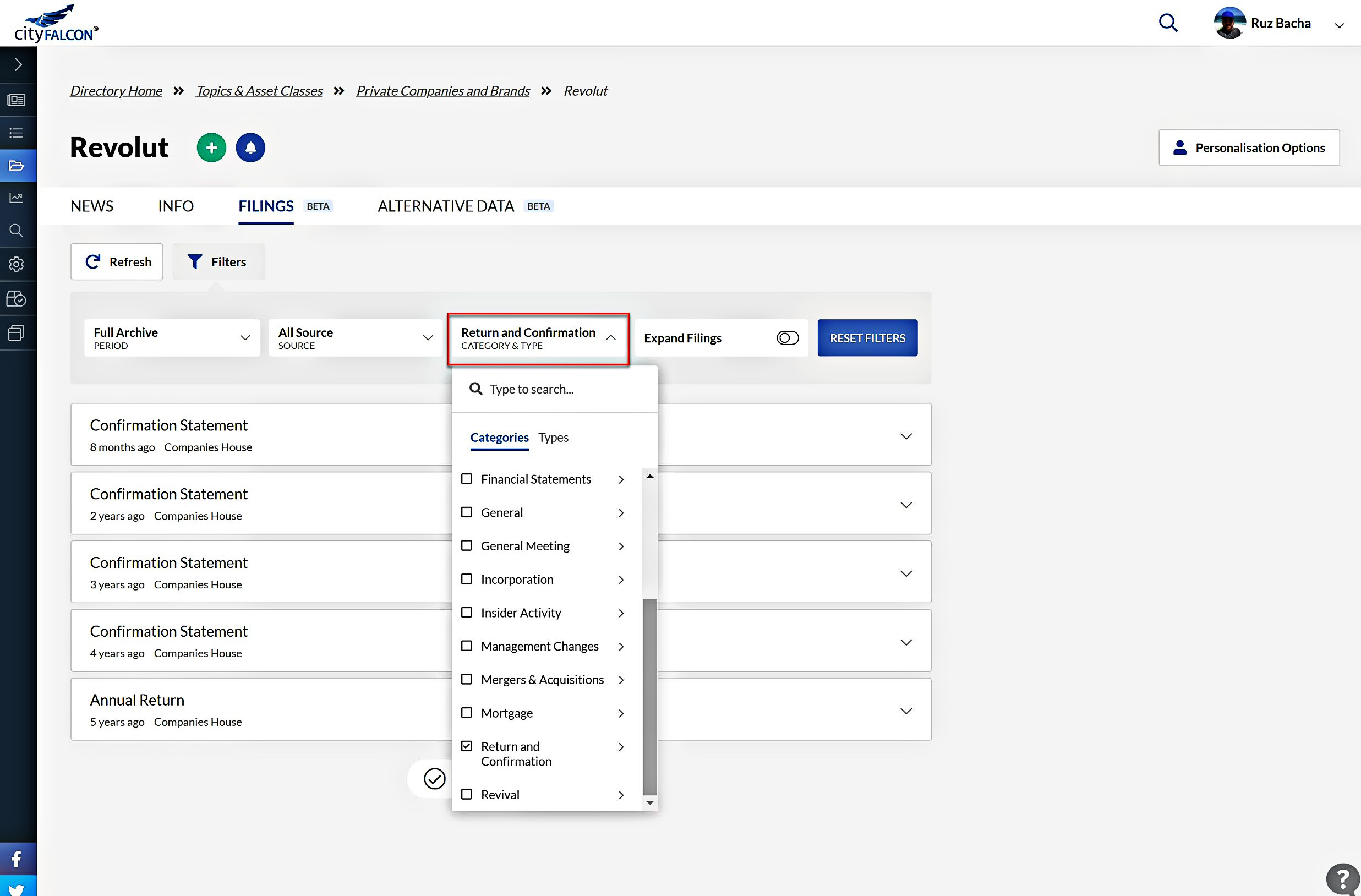

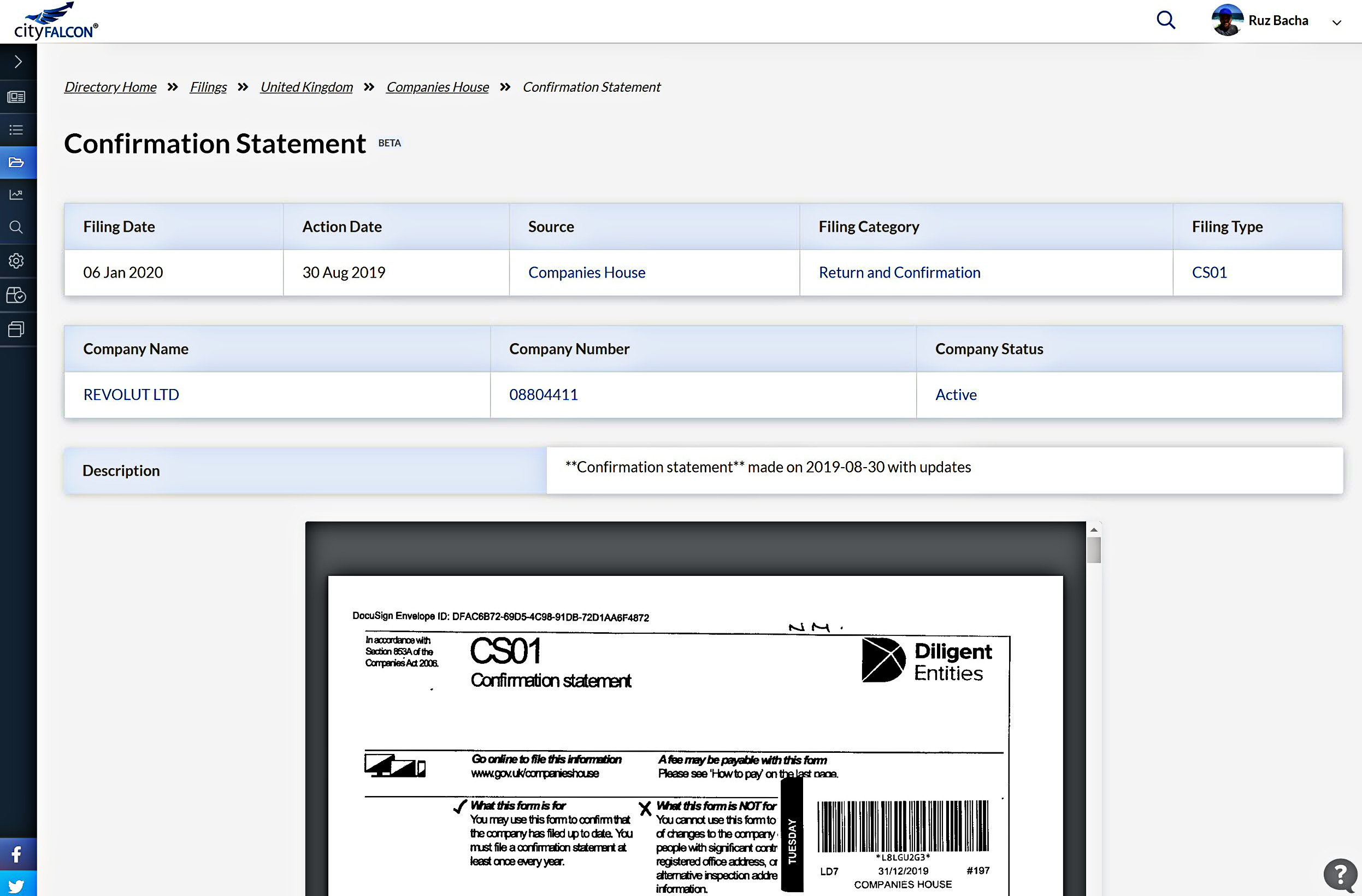

Companies House in the UK has made it relatively easy for you to find the investors. You need to look for ‘Confirmation Statement’ from the companies. Our filings “categories” make it very easy for you to find these, e.g. on Revolut’s page on our platform.

You can look at the full document with more info on the Confirmation Statement filings for Revolut by clicking the More button on the filings results list, which leads to a page like this:

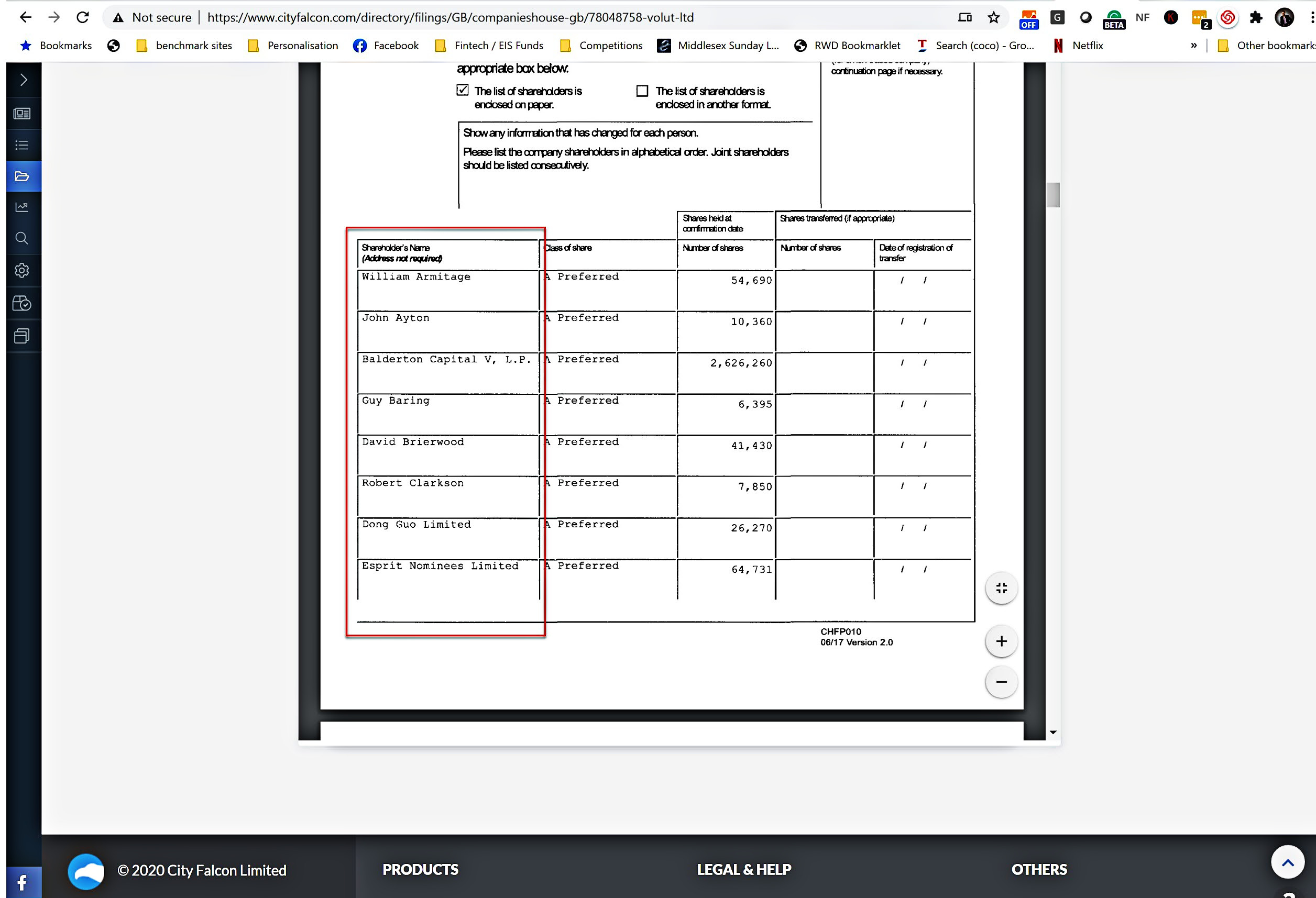

And then you can see the full list of investors in the company in the PDF (extracting investors is a future goal for us).

3. Will the company be able to compete? Understanding the macro picture and sectors is extremely important – is the market big enough for all players? What advantages do the incumbents have, etc.

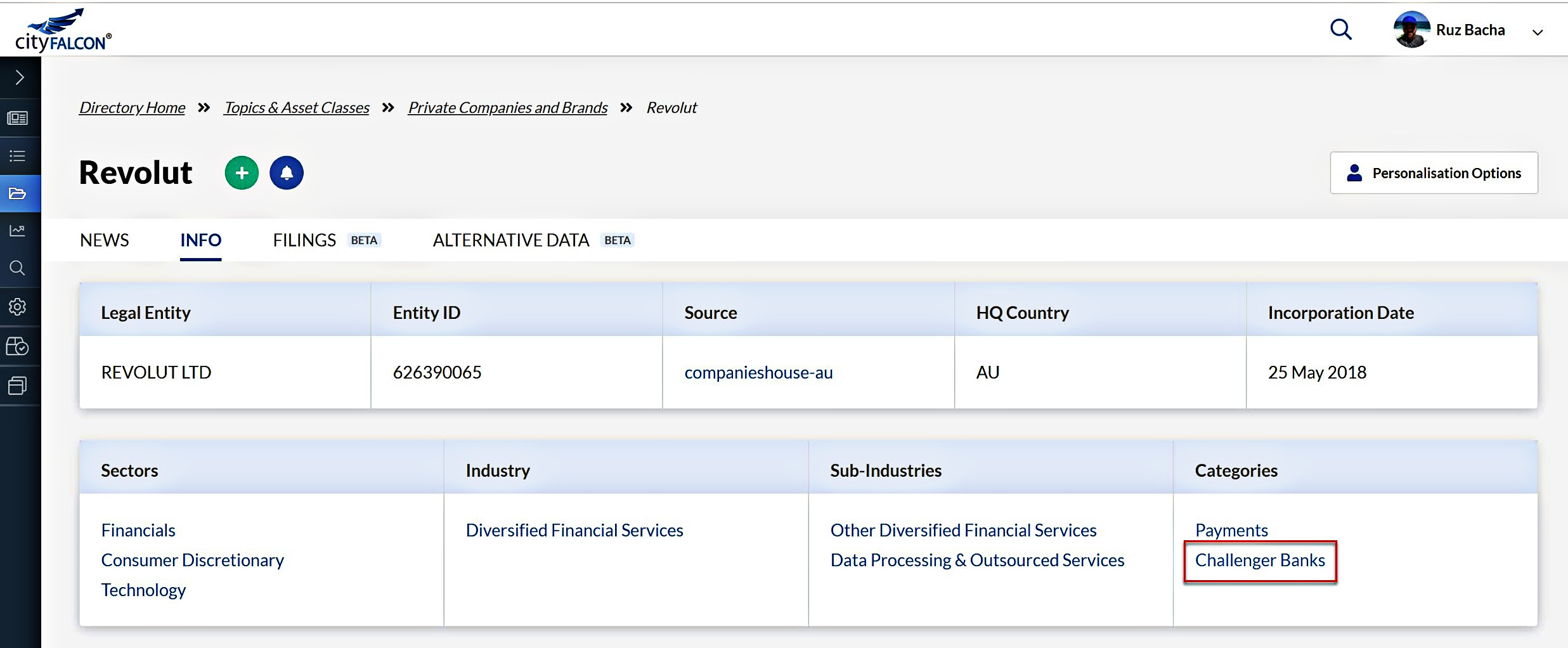

We have made it very easy for you by mapping sectors to companies, which you can find on the company’s Info page. If you are looking at Revolut (info page), you might want to look at the state of other challenger banks here, too.

Post-Investment Tracking

While we, at CityFALCON, update our investors with the highlights and lowlights each month, unfortunately, many companies do not provide any information for months to even years. Also, we have seen cases where companies have issued more capital without completing the required preemptions or issued at a price lower than agreed in the shareholders agreement. Some companies may have applied for bankruptcy protection and investors wouldn’t even know.

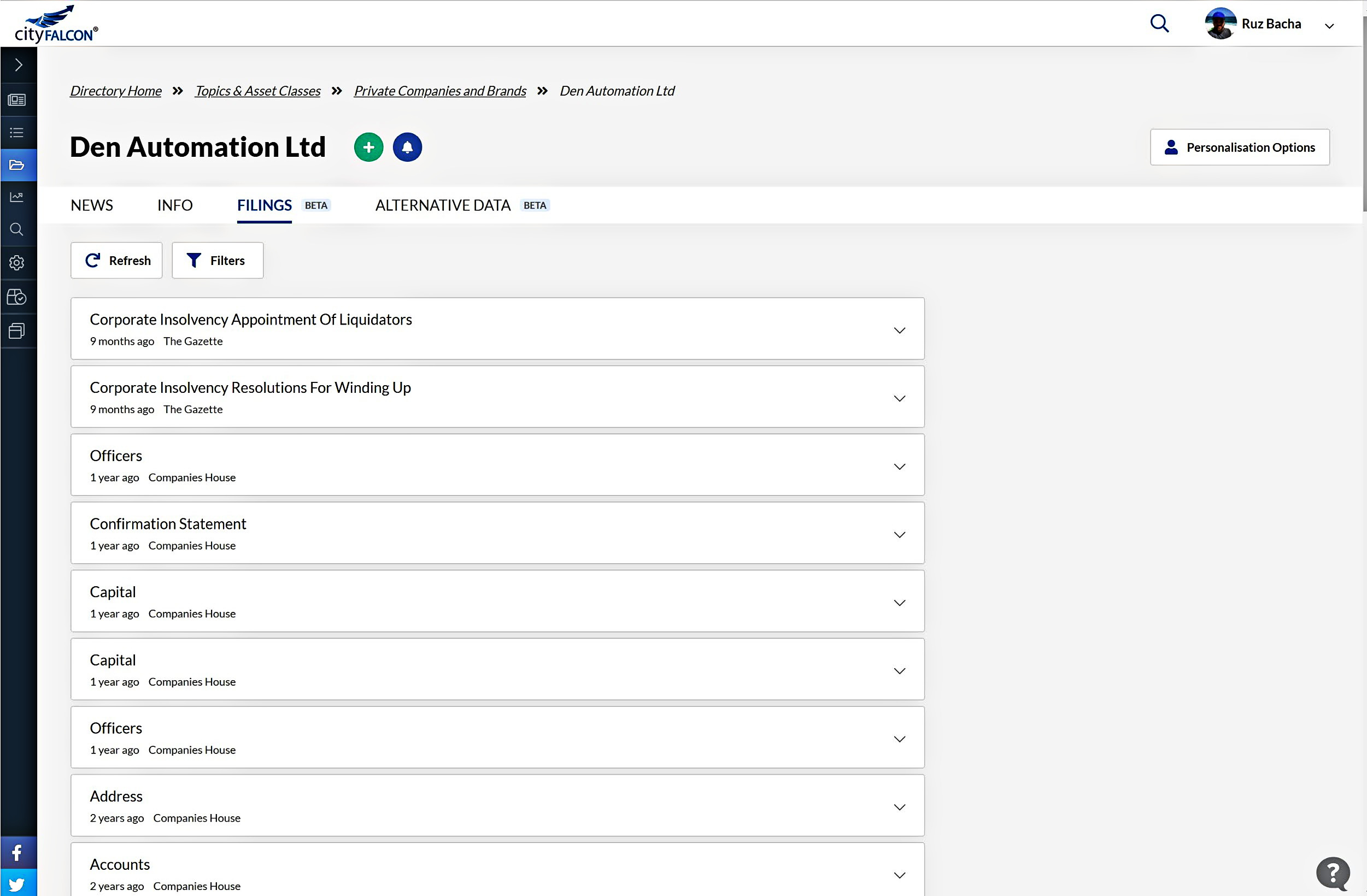

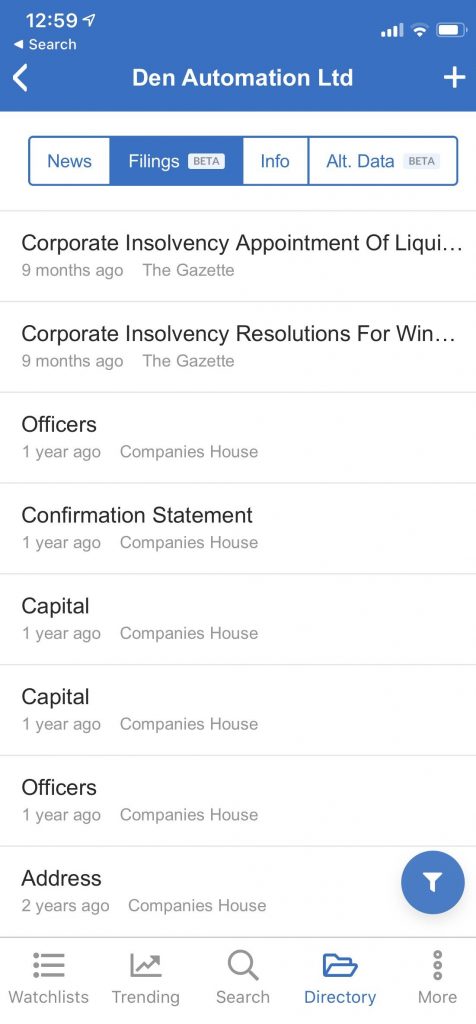

While we cannot detect every such issue upfront, reviewing the filings from UK Companies House, Gazette, and others could help in several cases.

Below is an example of tracking filings from the troubled Den Automation. You can see filings from multiple sources in one view.

Summary

What we have described above are only a few steps during the due diligence and post-investment tracking. We are using Big Data, AI, and machine learning to solve some of the problems faced by investors. As an entrepreneur and an investor, I have an understanding of both sides of the industry, so CityFALCON can better solve the problems, too. Finally, we are looking continuously to improve our products, and so if you have any suggestions, please let us know.

Leave a Reply