Commission-free is a hot buzzword in the brokerage and investing communities right now. Robinhood was one of the first FinTechs to launch and become successful with the commission-free strategy, and many other lean FinTechs have sprung up to compete, such as Zerodha in India. But traditional brokerage houses in the US, like Charles Schwab, TD Ameritrade, and Vanguard, are also getting in on the game, albeit with some catches for avoiding the commissions.

In the UK, we are seeing the same trend with several brokerages launching or announcing plans to launch commission-free trading. This is great news for market participants, particularly new investors, higher-frequency traders, and low-portfolio-value users. Every fixed-price trade cuts into profits, and frequent trading or low capital means little return per trade.

Beyond the economic realities of commission-free trading, FinTech companies model themselves more along the tech lines than the fin lines. General public opinion tends to be higher for tech companies than financial companies, and FinTechs sustain this opinion with better user experiences, transparency in cost structures, educating their clients instead of competing against them.

eToro is one of the first stock trading commission-free players in the UK and one of the faster-growing players worldwide. I signed up to their platform with c. $200, so I really put the low-portfolio-balance situation to the test. Below is my detailed review of the platform.

Their commission-free offer only pertains to stock trading, not the other assets that are available on the platform.

Disclaimer: We, at CityFALCON, have just signed an affiliate deal with eToro. So if you sign up through us, we get a referral fee. Of course, we’d never recommend any service without actually trying it out ourselves. Below is our candid review of their service.

Summary / TL;DR

An easy onboarding process, good user experience and no commissions on stocks make eToro’s trading product one of the best in the market. The ability to combine this with CFDs and other asset classes (not commission-free) and several advanced features may be great for advanced users but could confuse new investors. The social trading and community features make it different from an average broker. I’m only concerned about new investors and the more complex instruments, which can be riskier than newcomers understand.

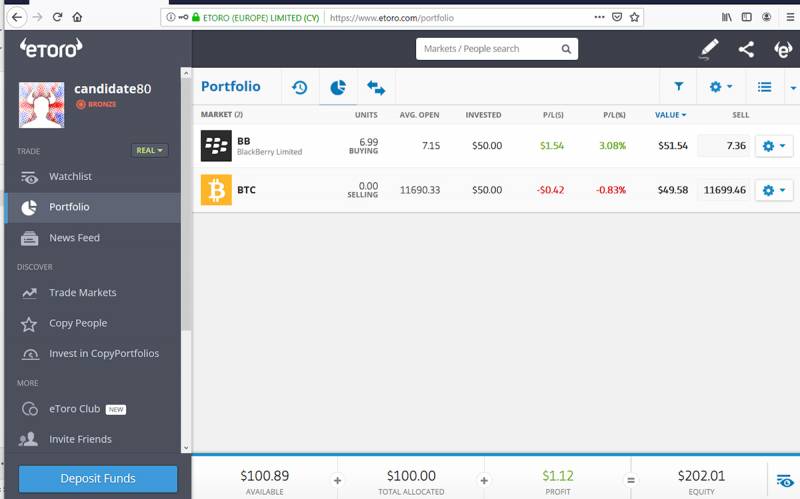

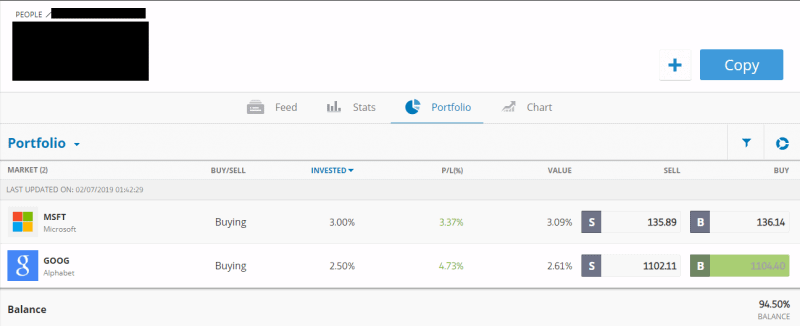

My portfolio on eToro:

Please note that our review of eToro here is only for the commission-free stock investing product, and we are not commenting on their other offerings like CFDs and cryptos.

Is it really commission-free for stocks? Are there any other costs involved?

The financial services industry is notorious for hidden fees and confusing fee structures. Commissions might look low but the broker widens the market spread. They might have fees on certain transactions that are difficult to ferret out.

As for commission free, yes, eToro is commission free when purchasing the underlying equity asset. If you buy stocks on eToro, there is no commission. If you want to short sell or use leverage, there is a charge, but for most new investors, the platform does offer a no-strings-attached, commission-free trading experience. It’s nice to see a broker that stands behind its claims.

If you do decide to get into any assets other than stocks, or if you wish to short sell or leverage your purchases, the story is a little different, based on spreads.

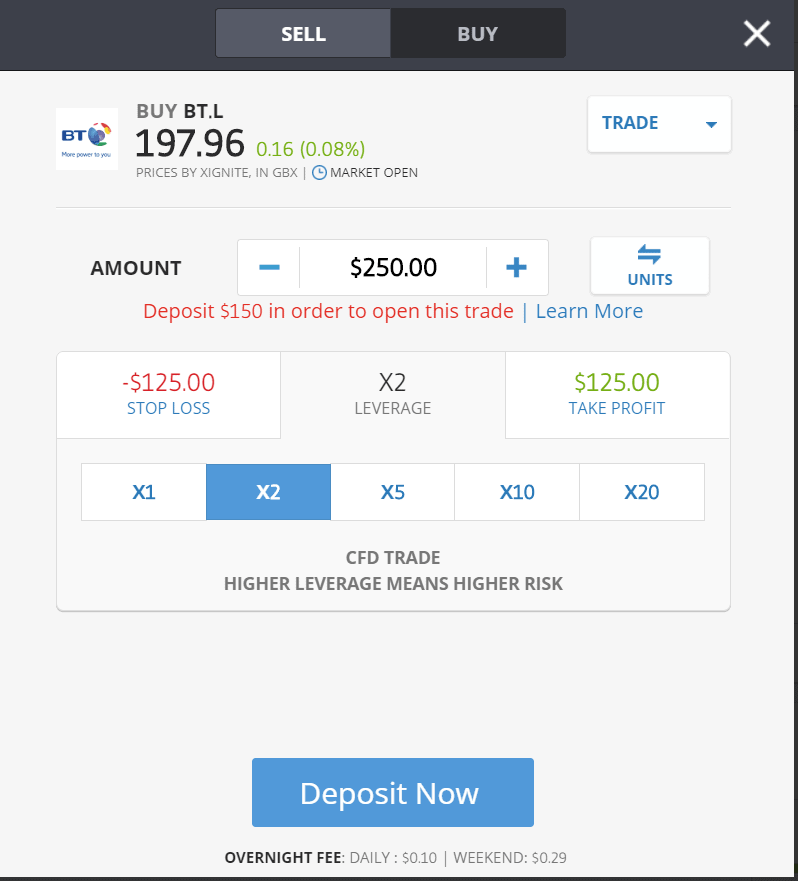

The spread-fee approach is quite common among spread betting and CFD brokers. For example, the sell and buy prices on the open market may be £100 and £102, respectively. That’s a spread of £2. The broker might charge £103 to purchase and will only buy your asset at £99. This gives them a £1 fee. eToro does this, too, for CFD trades – and it should be noted that any leveraged trade is a CFD trade!

Below is how it works on eToro. The non-leveraged purchase of BT is 197.88, but if we leverage, we must use a CFD. The purchase suddenly becomes a little more expensive at 197.96.

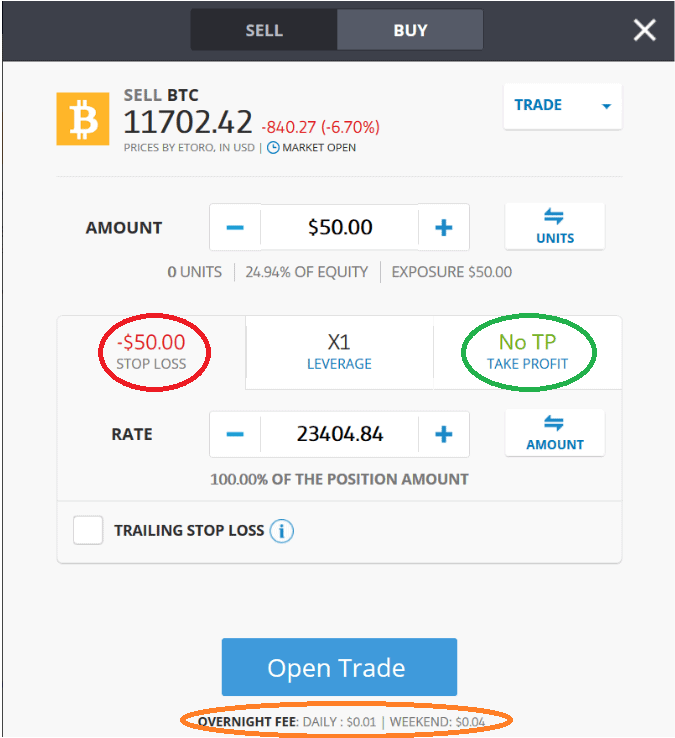

It is also important to note that leveraged trading may entail overnight fees, which are charged on positions for holding a CFD open while the market is closed.

Interesting, and particularly useful for UK investors and traders, is that eToro claims to pay the stamp duty tax on behalf of the user.

Now, there are spreads associated with non-equity instruments on eToro. Cryptocurrencies, national currencies, indices, ETFs, and commodities all have associated spreads as well as overnight fees. The other costs to consider are the $5 withdrawal fee, and the FX conversion fee of around 0.4%, which is comparable to other FX platforms like Transferwise. There is also an inactivity fee and a $30 minimum withdrawal amount.

See their fee schedule for the breakdown of all fees. The ones not associated with any asset class (withdrawal, FX, etc.) are at the bottom. Admittedly this is not the easiest for newcomers to digest, but it is a fundamental component of finance and trading which is unlikely to disappear anytime soon.

If you’re worried about these other fees, especially if you are just trading stock without leverage, their post comparing their own costs to those of other brokers might allay your worries.

Benefits of eToro commission-free trading for stocks

Apart from the low transaction costs of the service, there are some other benefits:

- Signing up is very easy and the onboarding process is clear. For those in the UK, completing the W-8BEN form online was easier than I have experienced at other brokers. My deposit was available in about 5 minutes and I could start trading right away.

- The user experience and design are appreciably better than some of those from incumbents. This supports the notion that FinTechs are concerned with their customer experience more so than traditional brokerages.

- There is a $100,000 virtual portfolio you can test your strategy on. It is much easier to be open with new ideas with money that isn’t real. Once real money is involved, people become notoriously risk-averse. This is especially true when it’s their own money.

- Advanced users could build and track a portfolio with stocks and other asset classes very easily. They can use CFDs for leverage up to 20 times, and they’re used for both short selling and leveraging long positions.

- eToro covers not only traditional asset classes, but CFDs, ETFs, and cryptocurrencies.

- The advanced features like stop losses and take profit could be quite useful for sophisticated investors and traders. This also allows one to control your losses when short selling

Drawbacks of eToro commission-free trading for stocks

I am a balanced reviewer, and I have some drawbacks to point out as well.

- Anyone trading non-equity assets on the platform will still pay fees

- For new investors, the mixing of CFDs, leverage, and cryptos may be quite overwhelming. These are not always clearly separated, either.

There are a couple default settings that may not be suited for new investors, such as the automatic application of stop losses and take profit conditions. They’re also quoted in the actual dollar amount lost or gained, not the stock price itself. For seasoned market participants, it might take a few seconds to realise the setup is for actual P&L, not stock price. This is especially true if the limits are set at around the stock price itself.

There are also pros and cons regarding the social aspect of the platform, which will be explained below.

Basics of the Platform

Now that we’ve discussed the fees and pros and cons of eToro, let’s look at their website and layout in a bit more detail.

eToro has five main sections: the watchlists on the front page, the portfolio page, a news feed, a trading area, and a page where you can find traders and investors to copy. The watchlists and portfolio sections are pretty standard for capital market-oriented products. There’s information on the market spread, the last trade, and price charts and changes. The portfolio will show you useful stats, like your entry price, the number of units you have (shares, coins, etc.), and your P&L since entering the trade.

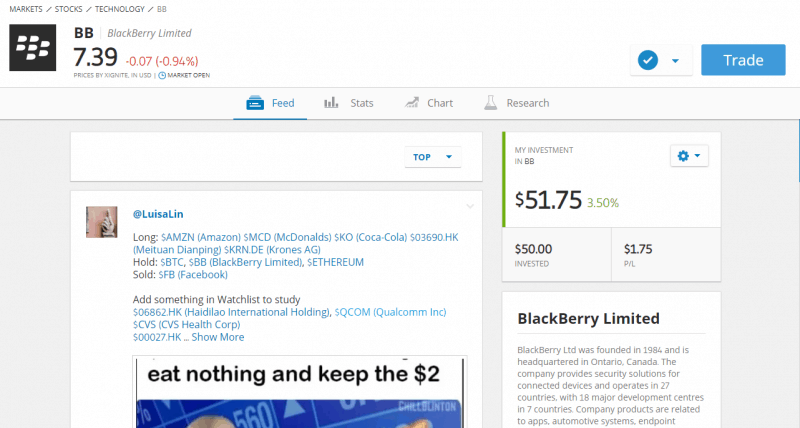

Drilling down any specific asset will give you more information on it. For stocks, there are prominent statistics like market cap and P/E ratio. Stock information pages also show you key numbers from the financial statements. Assets will have descriptions and profiles, too, so you can get acquainted with it before investing.

The differentiator for eToro – and presumably other social trading platforms – is the crowd-based sentiment scores and news feeds associated with every asset. The way people on the platform are trading and talking about an asset will cause its sentiment score to rise or fall, and you can see their actual comments in a news feed reminiscent of Twitter.

This is where much of the power of social trading platforms lies. Psychological finance is a powerful driver of price action, and participants often follow each other’s lead. You can benefit from other’s insights and, if there is a strong herd mentality, from the self-fulfilling trends produced because of it. Social trading platforms give you immediate insight into the thoughts of people actually trading it, whereas news published after-the-fact is not as valuable. Especially in the efficient markets of today, information is incorporated almost instantly.

The Social Aspect

Aside from being commission free for regular stocks, social trading is another major component of eToro. Humans have built increasingly complex systems to handle the interactions between people, and the capital markets are one of the most complex systems on that list. But the complexity can also make the capital markets challenging to understand and navigate.

Social trading platforms are a place to follow other traders and investors. The new market participants get seasoned, experienced traders and investors to follow, learn the market, and eventually go off on their own. More experienced participants can bounce around ideas and even become a portfolio leader. For everyone else, there’s a good combination of both.

Being able to copy successful market participants is the real value generator for people who are more interested in earning investment returns than making deep dives into company financials and doing their own screening and analysis. It’s kind of like robo-advising, except with human advisors. They’re just much cheaper than traditional financial advisors.

Of course, as with all investments, there is due diligence involved. When copying someone, the due diligence is ensuring the copied person actually is successful.

On the Copy People area of eToro, there are featured members at the top and various categories below. Categories include top investors, high- or low-risk profiles, and popular.

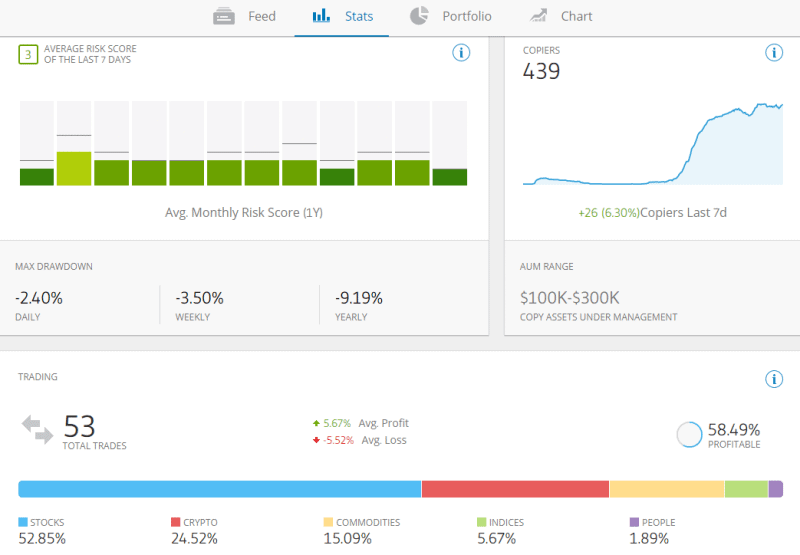

To assist your due diligence obligations, every profile shows multiple metrics. There are numbers to indicate returns over time, including daily returns of the last week. Different people have different performance in different market conditions. Some are better during stable times, while others thrive on chaotic price movements.

There are also risk ratings. Just because someone is low-risk doesn’t mean you won’t lose money, but you’re less likely to lose a lot of money quickly. Of course, big risk takers will probably have higher short-term returns when they’re doing well. There are also metrics indicating the number of followers and growth over time.

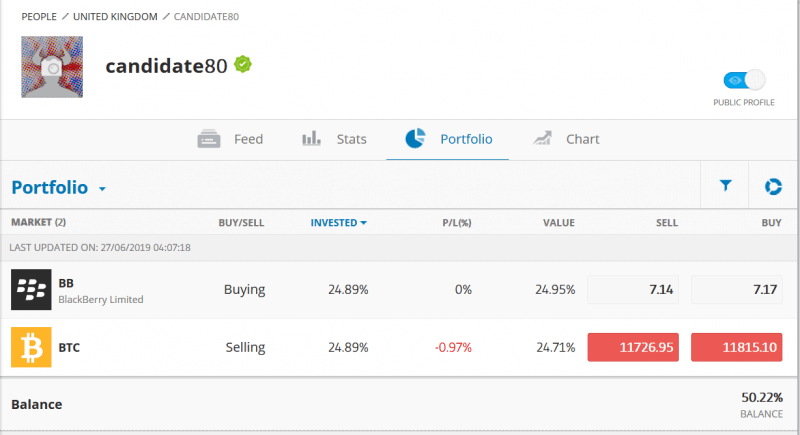

There is a breakdown of their portfolio and which assets they frequently trade, along with their profitability in those assets. The actual portfolio can be viewed, which shows their direction (buying/selling) and their P&L for those assets.

Each profile also has a news feed, where the person-to-be-copied broadcasts messages. This is quite useful to help copiers learn the investor’s mentality and how they trade. It is a goldmine of information for new traders, and it might give seasoned traders a fresh new outlook or approach.

The only issue is that, due to the financial incentives to become a leader, some people might manipulate their statistics. If you want to copy someone, you need to be vigilant about anomalies. It helps to watch a person for a little while before copying, too.

Finally, if you have an account, people will be able to see your performance and portfolio. Even if you just signed up! You can easily hide it by toggling the Public Profile button to off from the profile page.

If you do sign up to eToro, share your experiences in the comments below.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Leave a Reply