This is episode 2 in our new to investing series – Understanding Debt, Equity & Risk Reward Ratio. Enjoy!

Transcript of video

When you start thinking about investing in the stock market, you’ll hear a lot of financial jargon thrown into you. Today we’re going to talk about some of this jargon. We’re going to talk about debt, equity, and how companies raise funds to start run and grow their businesses.

I have a dream… Well, just kidding. I do have a dream but I can’t sing and my dream is to open a restaurant with healthy and delicious food, quality service, and reasonable prices… And if I was going to open a restaurant like this, I would need an upfront investment to cover the rent, the people, the groceries, and all the other upfront costs that are involved with opening something like that. Let’s say, maybe 50,000 pounds is what I’d need.

If you speak to your bank at this stage and ask for a loan most times the loan will be rejected. Or in return for the loan your bank would ask you for something that’s valuable such as property or equipment against which they will give you the loan, and this is something known as collateral.

Let’s take a step back and talk about something you’ll hear a lot about, when speaking to finance professionals.

The risk-reward ratio.

Finance professionals calculate this ratio using two factors:

- The level of risk in the investment

- The return they can expect to get out of the investment.

Investing 101 – Let’s get you started in the stock market.

Take for example, if you go to the bank to get a mortgage in order to buy property. The interest rate that they charge you will depend on the amount of deposit to put up front and could also depend on your credit rating. Why? Because if your credit rating is low, this means that the higher risk for them and they want to hire return for that risk, and then therefore, they will charge you a higher interest rate.

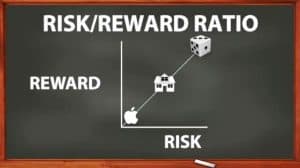

At the same time when a company such as Apple asks for a loan, the risk is very low and therefore, the bank actually gives Apple very low interest rates because they have strong cash flows to back up the money that’s being lent. Take a guess, how much do you think Apple is being charged for its 2.5 billion dollars of debts in March this year? Any ideas?

A very small 2%. No risk – low return.

Conversely, when you go to bet in a casino you often get double or nothing odds. High-risk – high-return.

So, as we can see, the risk for debt with Apple, the risk of buying a mortgage or buying property, and the risk of investing in a casino are very different profiles and therefore, the expected returns are also very different.

Going back to my restaurant, it’s very unlikely that the bank would give me alone because it would be considered very high-risk. Statistics show that 90% of new businesses fail. My won’t of course, but the bank would see it that way.

So, in this scenario the bank wouldn’t be able to calculate an interest rate to compensate for the risk they’d be taking.

What happens in these scenarios where there’s a high-risk business? Well, this is where equity comes in. Equity is when an investor gets a share in the business, and this means they share the upside and the downside for what happens with the business. Let’s say, you take out a loan of 100 pounds to grow some apples. Irrespective of whether you grow 1 apple, 3 apples, or 6 apples, you still have to pay the interest to the bank and you’ll pay the same interest whatever you grow.

Instead of debt imagine for that £100 pounds we gave a 30% equity stake in the business. Now if you grow 3 apples, you have to return 1 to the investor, and if you grow 6 apples you have to give 2 of them. However, if you grow nothing – you own nothing, which means for the investor they share an upside and the downside with you for the returns the business makes.

Let’s bring some structure to all of this. There are 3 ways a company can raise funds: debt, equity, or convertible debt. Let’s just talk about debt and equity today.

You go to a bank to get debt which is usually offered when the business had steady cash flow to pay back the interest, and the risk is relatively low. In order to raise equity you usually go to the stock market or private investors. This is normally when the upside is high but the risk is also high. This means they could be significant downsides and in some cases there’s the risk of a complete failure of the business.

Now that you understand the difference between debt and equity, and you know what a risk-reward ratio is, would you give me £20,000 for a 10% stake in my restaurant?

Leave a Reply