Most retail outlets, especially supermarkets, offer popular items such as milk, bread, etc. at extremely low prices and make higher margins through the long tail – branded biscuits, toiletries, etc. These are often referred to as ‘loss leaders’. Other businesses also provide products at a cheap price in order to induce customers to purchase other items. One of the most well-known examples of this is companies selling printers at a loss, but ultimately make money on the ink cartridges.

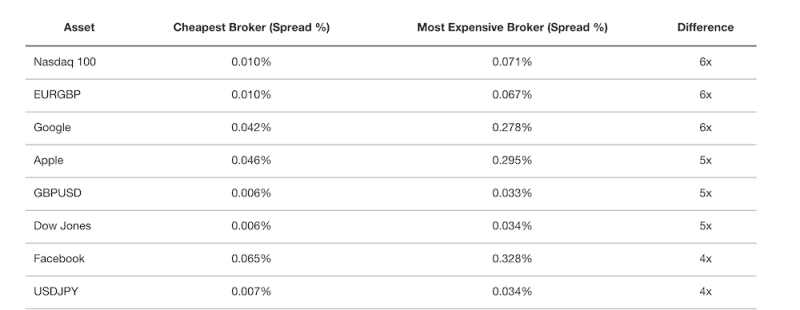

The leverage trading market (Spread Betting, CFD, and FX) shares this principle. Most brokers offer fixed and low spreads on popular indices, commodities and FX, but make more money on the less popular ones, especially equities. Every broker claims to have tight spreads on all assets, but in reality percentage spreads in the case of some assets can be as high as 2%, which will not allow you to adopt most trading strategies.

I’ve been spread betting since 2007, and used one broker for almost 5 years until I realised that I could have saved thousands of pounds trading with a different one. Today, I trade from 4-5 accounts, and select broker and financial instruments based on assets that I want to trade in and the time horizon. There is not a 10, 20 or 30 percent difference between the spreads provided by brokers; this figures could in fact go as high as 600% (6x). Here is an analysis of the difference for some popular assets from 13 brokers listed on http://www.CompareSpreadBetting.com

Minimising your transaction costs will not only increase your trading returns, but also allow you to adopt new strategies which require tight spreads.

04/12/2018 at 7:45 pm

I enjoy what you guys are usually up too. This kind of clever work and reporting! Keep up the wonderful works guys I’ve incorporated you guys to blogroll.