Summary

- 196 IPOs with $34.5bn raised in 2015 on the major American stock exchanges which is much lower than in 2014

- 43% of the IPOs in 2015 were by healthcare companies, followed by financial companies at 18% and technology companies at 15%

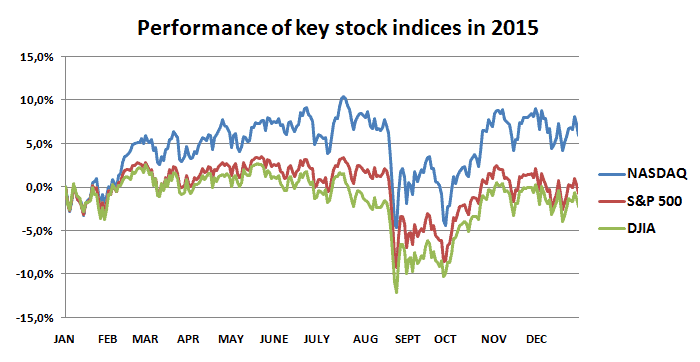

- The weighted arithmetic mean of return on IPOs from their listing date till the end of 2015 was -5.4% compared to 5.9% Nasdaq growth, 2.3% DJIA drop, and 0.7% S&P 500 drop in 2015

- Apart from technology IPOs that generated a return of 6.93%, most other sectors suffered, especially IPOs in consumer goods and utilities which were down 28.74% and 48.35% respectively

- Aclaris Therapeutics Inc has topped the percentage return of 148% within less than 4 months of listing, while MaxPoint Interactive Inc lost 85% of its value in less than 1 year.

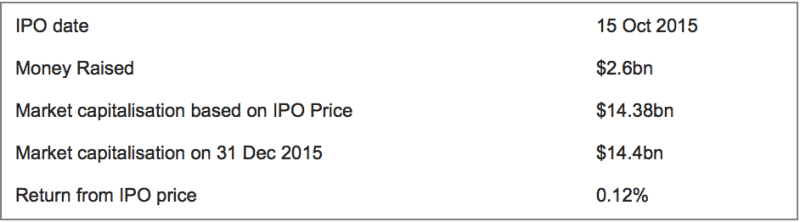

- The biggest IPOs that raised more than $1bn have had mostly negative returns: First Data Corp has been flat, Tallgrass Energy has been down 45% since its IPO, Columbia Pipeline Partners is down 24%

- Some of the popular better-known IPOs that did well include Fitbit up 48%, Atlassian that owns JIRA up 43%, Go Daddy up 60%, Match Group up 13%, and Square up 45%

- Others have had mixed results: Ferrari is down 8%, Box has been flat

Methodology and Limitations of Analysis

- This analysis considers only companies listed on the majors US exchanges

- Most financial charts show performance based on the listing price but we have taken the extra step of adding the IPO price to the chart.

- Performance for the IPOs is actual performance for the period from the IPO date to the end of the year; the figures have not been annualised.

- Data has been accumulated from different sources, which may have different definitions of metrics, and hence, this analysis should be considered as indicative, and investors should do their own due diligence before making any decisions.

Overall IPO market in 2015

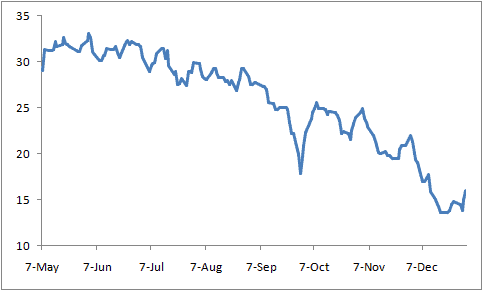

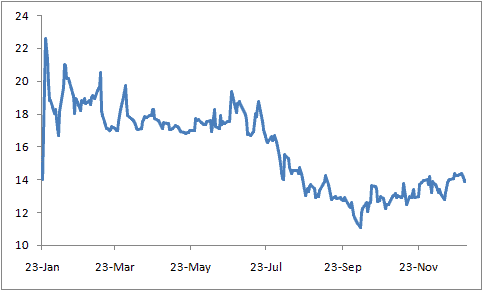

196 companies started trading at major American stock exchanges (NYSE, NASDAQ, and AMEX) during 2015. IPO activity was lower compared to 2014. In 2015 36% lower number of companies launched their IPOs compared to 2014 when the number was 304. Only $34.5 billion was raised in 2015 compared to $89 billion in 2014. (Source: NASDAQ).

Stock market volatility caused by geopolitical tensions, uncertainty over interest rates, and structural issues in developing markets could have resulted in lower number of IPOs and overall market conjuncture. 2015 became the worst year after the 2008 meltdown in terms of stock market growth. The best performance this year was by NASDAQ with 5,9% growth, but S&P 500 and DJIA dipped 0.7% and 2.3% respectively in 2015.

(Source: Own analysis,Yahoo finance)

Performance by industry

As shown by NASDAQ’s performance, Technology was the only industry that provided positive returns in 2015. The biggest damage was brought to the companies that were operating in a primary sector of economy.

Note: IPOs performance was tracked from the first day of their listing till the end of 2015, while industries performance were tracked through the whole 2015

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

2015 may not have been the right year to be listed for most companies operating in the primary sector of economy. However, there were some IPOs that have managed to outperform their peers and stock market as a whole.

Here is the list of best 2015 IPOs performances by industry:

Basic Materials – Tantech Holdings Ltd (31.5%);

Conglomerates – Atlantic Alliance Partnership Corp (1,1%);

Consumer Goods – Multi Packaging Solutions International Ltd (33.46%);

Financial – Franklin Financial Network Inc (49.43%);

Health Care – Aclaris Therapeutics Inc (139.00%);

Industrial Goods – Aqua Metals Inc (6.6%);

Services – Shake Shack Inc (88.57%);

Technology – China Customer Relations Centers Inc (99.00%);

Utilities – 8point3 Energy Partners Lp (-23.14%).

10 big / popular IPOs of 2015

- First Data Corp

First Data is a global payment technology solutions company having footprint of 6 million merchants & handling 45% of all US credit and debit transactions.

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

(Source: Own analysis, Yahoo Finance, NASDAQ)

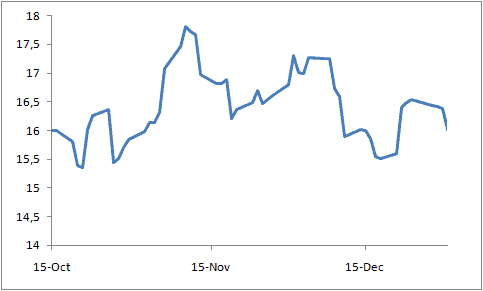

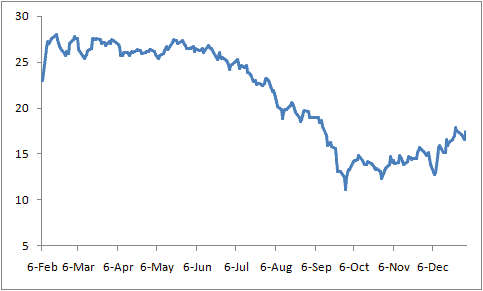

Tallgrass Energy GP LP is engaged in natural gas transportation, storage and processing. The Company holds indirect interests in the general partner of Tallgrass Energy Partners, LP (TEP), including all of TEP’s incentive distribution rights.

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

style=”max-width: 100%; height: auto;”

(Source: Own analysis, Yahoo Finance, NASDAQ)

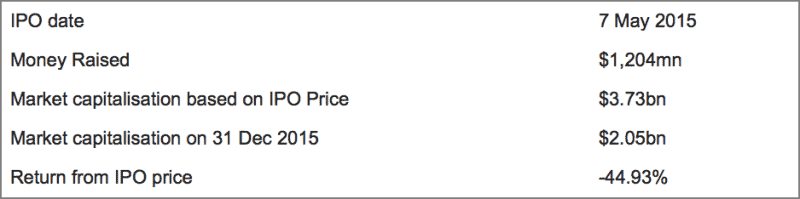

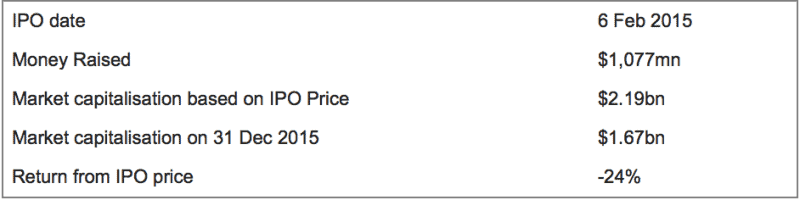

- Columbia Pipeline Partners Lp

The company operates in the natural gas transmission and storage business.

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

(Source: Own analysis, Yahoo Finance, NASDAQ)

Ferrari is an Italian luxury sports car manufacturer. Fiat S.p.A. owning 90% of Ferrari on January 3, 2016 spun off its 80% stake to its shareholders. Combining high prices, strong demand, and high margins, Ferrari is able to generate substantial profits despite a low production volume (7000 cars annually).

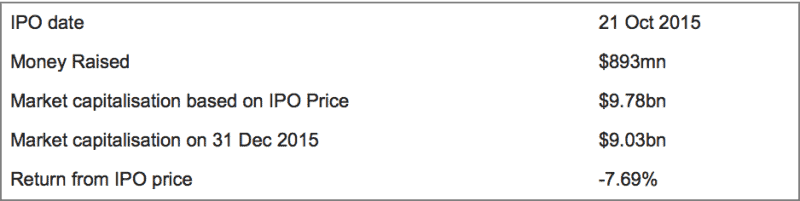

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

(Source: Own analysis, Yahoo Finance, NASDAQ)

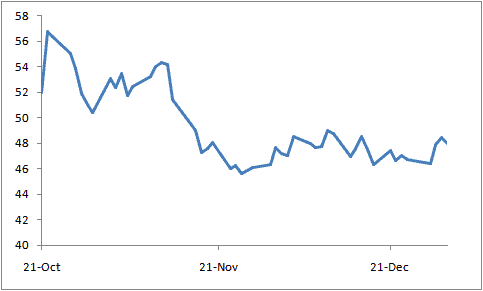

Fitbit is a provider of health and fitness products. The share prices tumbled after Fitbit Blaze Smartwatch revea,l but the stock is trading higher than its June IPO price of $20.

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

(Source: Own analysis, Yahoo Finance, NASDAQ)

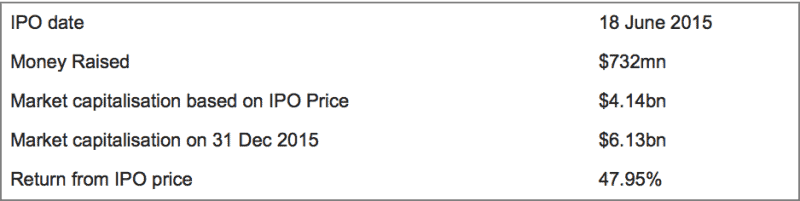

- Atlassian Corp Plc

The company is engaged in software design, development, licensing and maintenance, and also provides software hosting services. Atlassian serves over 50,000 customers globally, including 85 of the Fortune 100.

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

(Source: Own analysis, Yahoo Finance, NASDAQ)

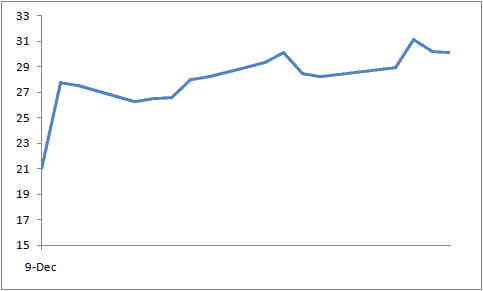

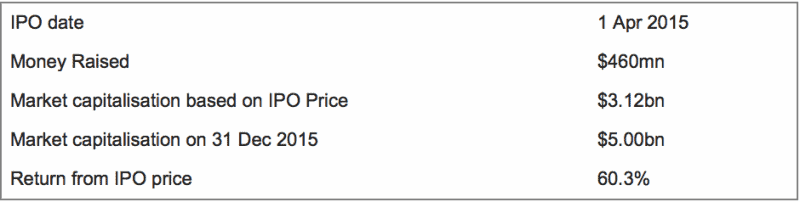

- GoDaddy Inc

GoDaddy is Internet domain registrar and web hosting company. It serves more than 12 million customers and has more than 59 million domain names under management.

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

(Source: Own analysis, Yahoo Finance, NASDAQ)

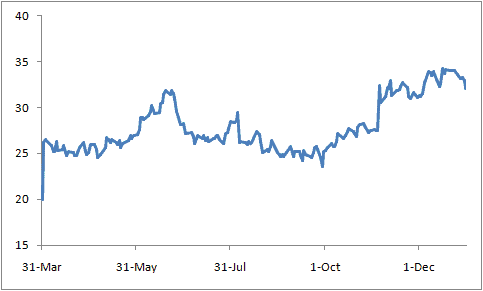

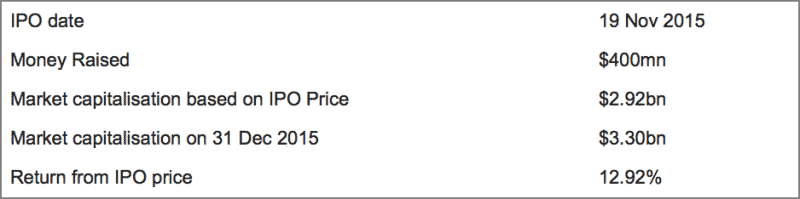

- Match Group Inc

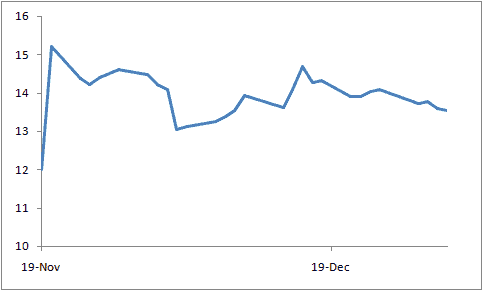

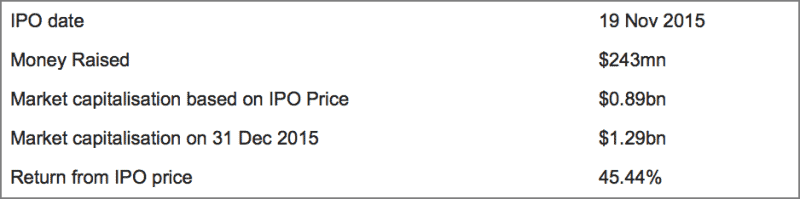

Match Group, Inc. is engaged in providing dating products. The Company operates through two segments: Dating and Non-dating. The Company operates a portfolio of over 45 brands. Goldman Sachs recommended selling Match’s stock and assigned it the price target of $12, saying that online dating sites have limited growth opportunities, whereas, Match trades at about 10 times expected earnings.

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

(Source: Own analysis, Yahoo Finance, NASDAQ)

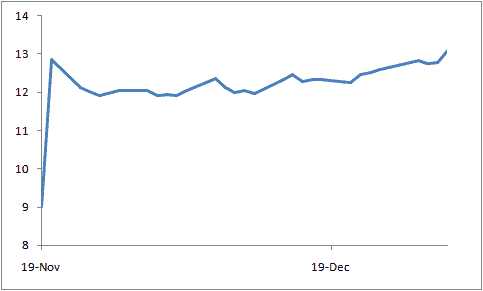

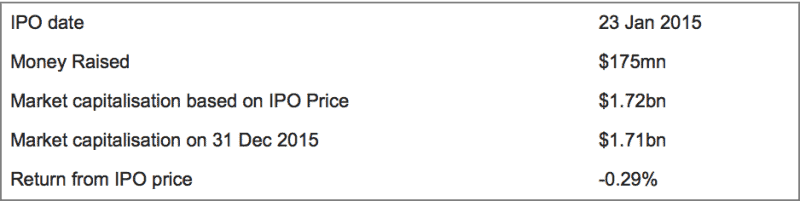

- Square Inc

Square Inc is a financial and merchant services aggregator and mobile payment company. The company is given a “strong-buy” rating by most analysts.

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

(Source: Own analysis, Yahoo Finance, NASDAQ)

10. Box Inc

Box provides a cloud-based, mobile-optimized Enterprise Content Collaboration platform – Box OneCloud ecosystem which gives access to around 1,300 iOS and Android third-party applications. Vetr upgraded Box from a “buy” rating to a “strong-buy” rating and set a $15.06 price target for the company.

(Source: Own analysis, NASDAQ, Google Finance, Yahoo Finance)

(Source: Own analysis, Yahoo Finance, NASDAQ)

Leave a Reply