Disclaimer: This is a guest post from Michael Wiggins De Oliveira, and does not reflect the views of CityFALCON and its stakeholders.

Resolute Forest Product (RFP)

Date: 10/3/2017

Market Cap: ~ $400m

Price per share: $4.50

Net debt: ~$761m

EV: 1.1b

Idea Summary:

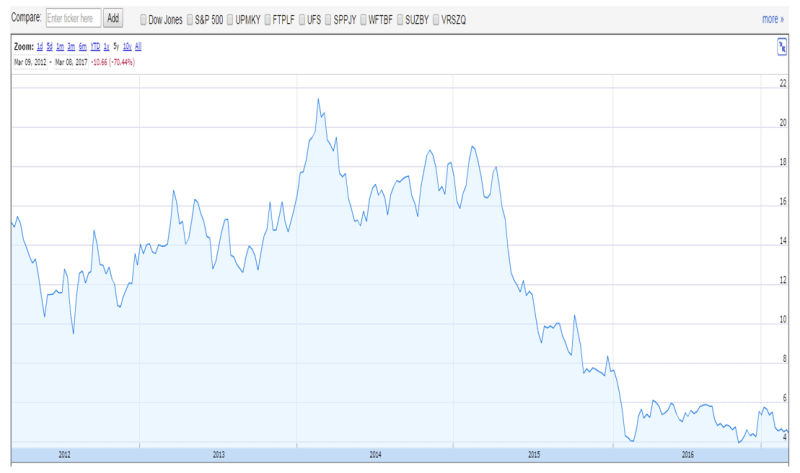

Resolute is a diversified company that sells forest products. It has a lot of pessimism priced in but none of the hope. After years of underperformance, shareholders are tired and selling without any regard for price. As the company starts to emerge from this commodity downturn affecting wood products I believe that a turnaround will be evident over the next 24 months and its share price will adjust to reflect that “new” found hope. I can see upside potential of about 50%.

Overview

Resolute has 5 main operating segments:

1) Market pulp

2) Tissue

3) Wood products

4) Newsprint

5) Specialty papers

I will go through each segment in turn and include a very conservative valuation on each segment.

Market Pulp

– Resolute is the third largest pulp producer in North America.

– Products are used in packaging, specialty paper products, diapers and others.

– It acquired Fibrek in 2012 for approximately $126m.

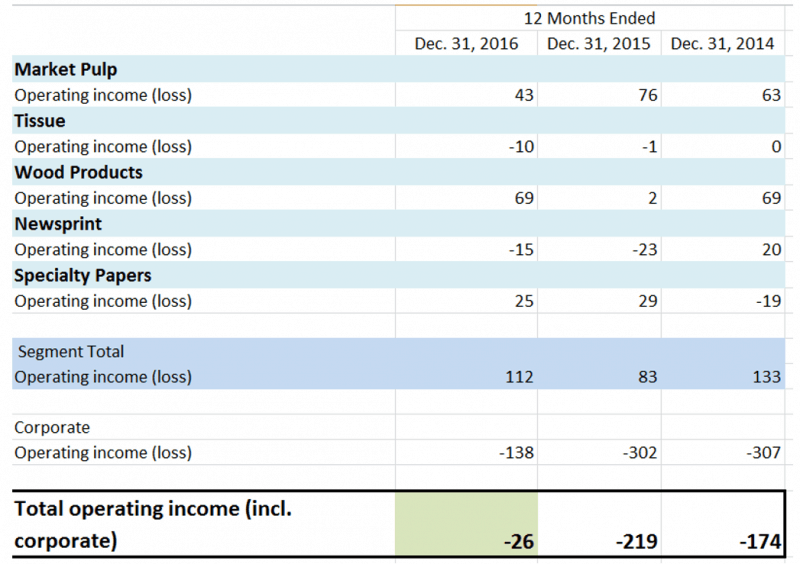

– Valuation: operating income (EBIT); $43m (2016) with a 5x multiple because its revenue appears to be declining comes to $215m.

Tissue

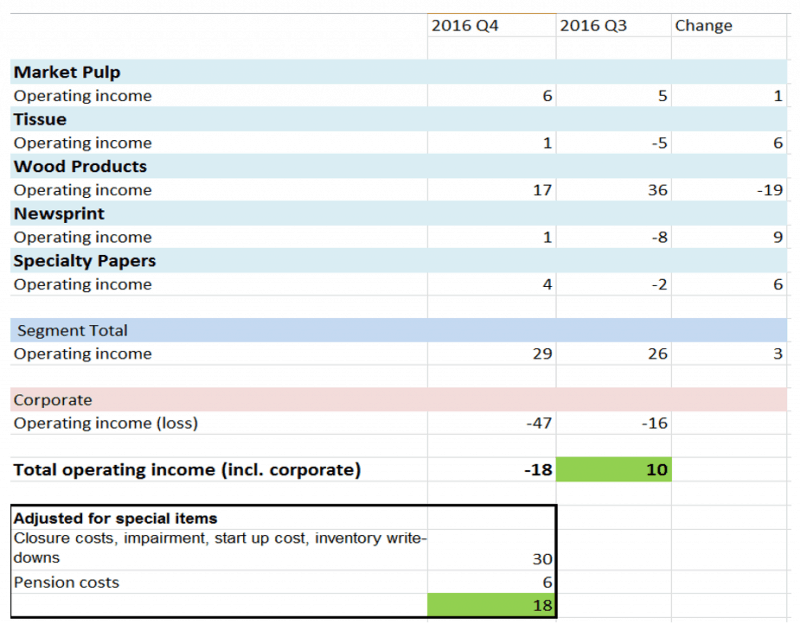

– This is a new segment for Resolute. Once the company solved its operational problems in the last two-quarters of 2016, this has actually started to be accretive to the bottom line (see below for quarter over quarter break down). Management has targeted EBITDA for 2017 of between $8m-$12m.

– Resolute acquired Atlas just a few years ago for $150m

– Valued to be at least $50m.

Wood Products

– Overall a consistent earner of operating income.

– Sold into the improving US housing market.

– It is projected to continue its gradual recovery in 2017, and then set to grow. But even without any growth capabilities, let me put a 6x multiple on operating income, making it worth approximately $415m.

Newsprint

– Resolute services newspaper publishers worldwide

– This segment has been a persistent headwind for several years as a lot of content has gone online as well as many competitors have been increasing the supply of newsprint in the market.

– Resolute has produced a small amount of operating income last quarter. Say $4m and put a small multiple to account for this business’s headwinds and its likely declining EBIT. Therefore, 4x multiple which comes to roughly $15m.

Speciality paper

– One the largest producer of coated and uncoated mechanical papers. Used in books, coupons, etc.

– Its difficult to say how it is going to perform in the future, but to be conservative let’s put a 5x on the $11.6m average operating income, comes to $55m.

Altogether, these segments are worth $750m.

Finally, I have left out corporate overhead. It is difficult to say how much more management can cut back on its excess fat and improve the company’s margins, but let me continue in the same conservative manner and highlight in the table below that it appears that management have already made a significant improvement to its corporate overhead and in the last two-quarters it actually generated positive adjusted operating income (including overhead). I should also point out that Resolute although cyclical is not particularly seasonal. And should it be able to grow a little its operating income it is not unreasonable that fair value would be at least $700m or $7.8 per share.

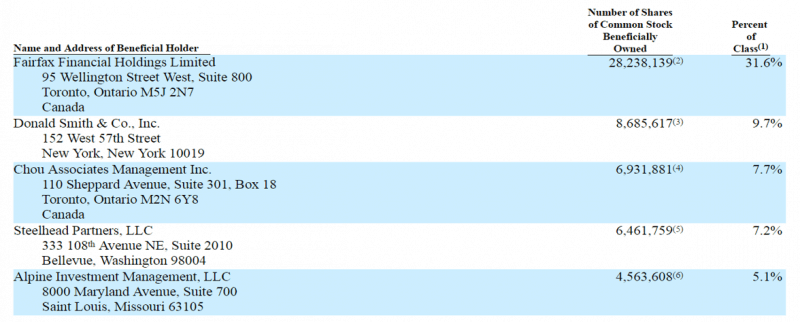

Biggest Shareholders

If I have not been able to persuade you that there is value to be made in Resolute, I will now highlight the fact that Prem Watsa owns approximately 34% of the outstanding stock (insidercow.com), slightly up from when the proxy was last published, meaning he has been buying over the last 12 months.

Additionally, another superb value investor, Francis Chou owns a material amount the outstanding stock is now up to 8% of the outstanding stock. Chou bought Resolute when the company was trading for around $1B.

So if it’s good enough for them at north of $1B, its good enough for me at $400m.

Conclusion

There is obviously a lot of dislike and disgust when it comes to investing in a cyclical commodity-like company. There are many factors that are totally outside of management’s control, least of all the price of its products and the supply and demand interactions in the market. However, in spite of that, I feel that the company is cheap relative to its potential when the turnaround starts to materialize 50% upside potential.

Please remember that this article is not a recommendation to purchase shares of any of the securities mentioned. Investing in out-of-favour securities has risks that may not be suitable for you. Please do your own due diligence to reach your own conclusions. Thanks for reading.

If you’d like to track real-time relevant financial news for Resolute Forest Products check it out here.

Leave a Reply