Portfolio management is an art. It is the art of making the correct, risk-adjusted, investment decisions that suit your specific investment time horizon. As with any art, it takes time, patience and experience to achieve the optimal result. In this article, we are going to reveal the core principles of constructing the optimal risk-adjusted portfolio, a core concept in the field of financial management and important to know for any personal investor.

Before beginning the portfolio construction process, an investor needs to reflect upon two constants, unique to the individual investor, which will greatly determine how the portfolio is constructed. These two constants act as restrictions, which guide how the portfolio is balanced, which assets are included, and how long each asset should be held.

1. Risk tolerance

Finance, especially investing, is entirely about the level of return per unit of risk. It is generally understood that if an asset produces a higher return, it generally comes with higher risk. Therefore, before setting out to construct portfolios, each investor must define this ratio for themselves, for a particular time period. In the finance realm, this is known broadly as ‘risk tolerance’, and is the initial basis from which you start constructing your portfolio. In calculating this metric, you must first define the amount of money which you can afford to lose. Next, to calculate the actual metric is very simply. You simply divide the dollar-value of assets which you can afford to lose by the initial investment amount. This will provide you with a percentage which roughly represents your risk tolerance.

Example: If you have decided that it is acceptable for you to lose $1,500 from a portfolio that is valued at $25,000, your personal risk tolerance will be ~6%.

2. Time horizon

The second metric which needs to be decided is the time horizon for your investment. Each investor must decide when they will need access to those funds again, to determine how long they can hold the portfolio assets. If you are unsure of this, reflect upon what you are investing for. Why do you wish to invest? Answering that question can not only help you to decide what type of investment instruments you should consider, but it should also help you decide which investments you should avoid and how long to hold each particular asset before selling. One should also take into account portfolio volatility, which could dissuade an investor from investing in the short term; however the same volatility may be more acceptable given a longer investment horizon.

Having defined the above constants, you are ready to start creating your own investment portfolio.

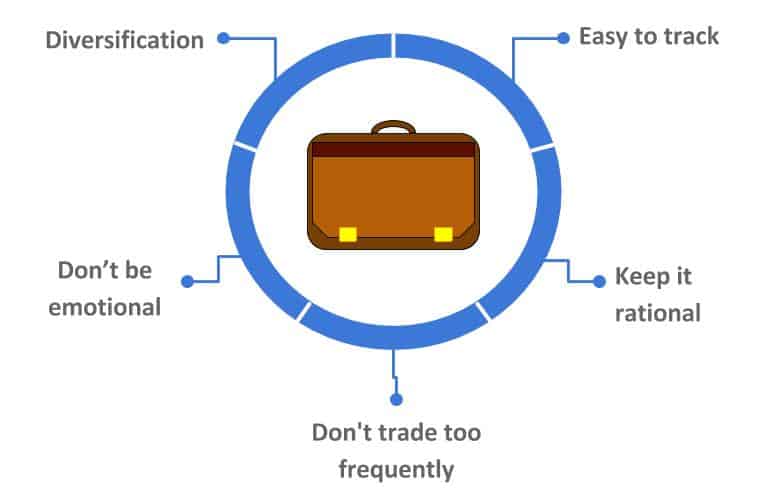

- Diversification. Never put all your eggs into one basket. Not even Warren Buffet can predict the future of the market conjuncture with 100% certainty. There are always unforeseen events which can dramatically lead reality astray from your prediction, introducing to your chosen asset. As a result, it’s better to choose several assets to invest in, because the probability of all of them depreciating at the same time is much lower than the probability of a single asset doing the same.

- Limit the number of assets. While diversifying is a good thing, too much diversification is not. The number of assets which you hold in your portfolio must not exceed what you can reasonably monitor. You should keep a close eye on your portfolio, and adapt to major changes in the market conjuncture. Holding a plethora of assets can result in confusion, and this confusion could lead to portfolio depreciation.

- Be pragmatic. Dedicate at least one day per fiscal quarter to analyze the performance and composition of your portfolio. You should know exactly what is happening with each asset, and why. That information will help you make informed decisions to maintain the health of your overall portfolio. Investment decisions warrant further reasoning than “I have a feeling it will go up in value.”

- Don’t trade too frequently. Find an asset allocation that works for you and only adjust it in case of major life events, which would change your risk tolerance or time horizon. Don’t try to time the market because it is the fastest way to lose your money, as investment fees and wrong entering/exit points will diminish your capital. You should remember that there’s a large difference between a day-trader and an investor.

- Don’t be emotional. Markets are constantly fluctuating around long-term trends, so there are times when the economy as a whole will act irrationally. Mass panicking during downturns and buying hysteria during upturns leads to these investors typically buying high and selling low. To be truly successful you must follow your initial investment strategy, and resist the temptation to buy & sell based on emotion.

Following the above advice, you will end up with a strong and stable portfolio which is personalized to your risk-return needs.

Investing 101 – Let’s get you started in the stock market.

Now, we are going to provide you with a basic asset allocation strategy which you can use in constructing your initial portfolio. While there exist numerous financial instruments with which you could build your portfolio, in general, the average portfolio consists of ETFs, bonds and individual stocks. The proportion each asset represents within your portfolio depends on personal risk tolerance, investment horizons and economic conjuncture. The only thing that is clear in this equation is that the less experienced of an investor that you are, the smaller proportion of stocks you should hold in your portfolio.

The basic investment allocation strategy which best suits inexperienced investors is called the “three-fund portfolio”. It suits a financial novice, not because of its low return, but because of its construction-simplicity, which doesn’t require a lot of research. This allocation strategy uses only basic asset classes. Typical three-fund portfolio consists of such elements as:

- Domestic stock “total market index fund” (S&P 500)

- International stock “total market index fund”

- Bond “total market index fund”

A traditional three-fund portfolio is based on the two fundamental asset classes, stocks and bonds, and suggests that the investor should hold both domestic and international stocks. Thus, you have to decide what percentage of your portfolio you wish to invest in domestic stocks, international stocks and bonds. Bonds are usually considered to be a more stable but less profitable asset class. If you are a confident and experienced investor, and don’t mind taking more risk; it is recommended that you add individual stocks to your portfolio, but we personally don’t advise investing more than 20% in it.

For the investors who are seeking for an easy way of tracking their investment portfolio we have created CityFALCON. Our financial news-aggregator gathers news from all corners of the internet, and scores each piece according to our proprietary algorithm. As a result, we help you save large amounts of time researching your portfolio, and provide an effortless way to stay in the loop with all major events relevant to your specific portfolio.

We would like to finish this article with a quote of the man considered to be the father of value investing:

“The individual investor should act consistently as an investor and not as a speculator.” – Benjamin Graham

06/01/2017 at 8:43 am

I’m truly enjoying the design and layout of your website. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a developer to create your theme? Fantastic work!

04/04/2020 at 8:39 am

This is really a awesome information. Thank you for this informative post.